There are a lot of exam options for students who are interested in accounts and commerce.

The two main exams are an accountant student CPA which is the Certified Public Accountants exam, and CMA, which is the Certified Management Accountant exam.

Upon clearing these exams, there are a lot of job offers that can brighten the future of trainee accountant students. In order to perform their best, the aspirants need to understand the exam comprehensively.

Key Takeaways

- CPA (Certified Public Accountant) focuses on auditing, taxation, and financial reporting, while CMA (Certified Management Accountant) emphasizes managerial accounting and financial analysis.

- CPA certification requires passing the Uniform CPA Exam, while the CMA designation requires passing the CMA Exam.

- CPAs work in public accounting firms, while CMAs tend to work in corporate settings as financial managers or analysts.

CPA vs CMA

A CPA (Certified Public Accountant) is a professional who has passed the CPA examination and met other state licensing requirements, working in public accounting. A CMA (Certified Management Accountant) is a professional credential in advanced management accounting and financial management fields.

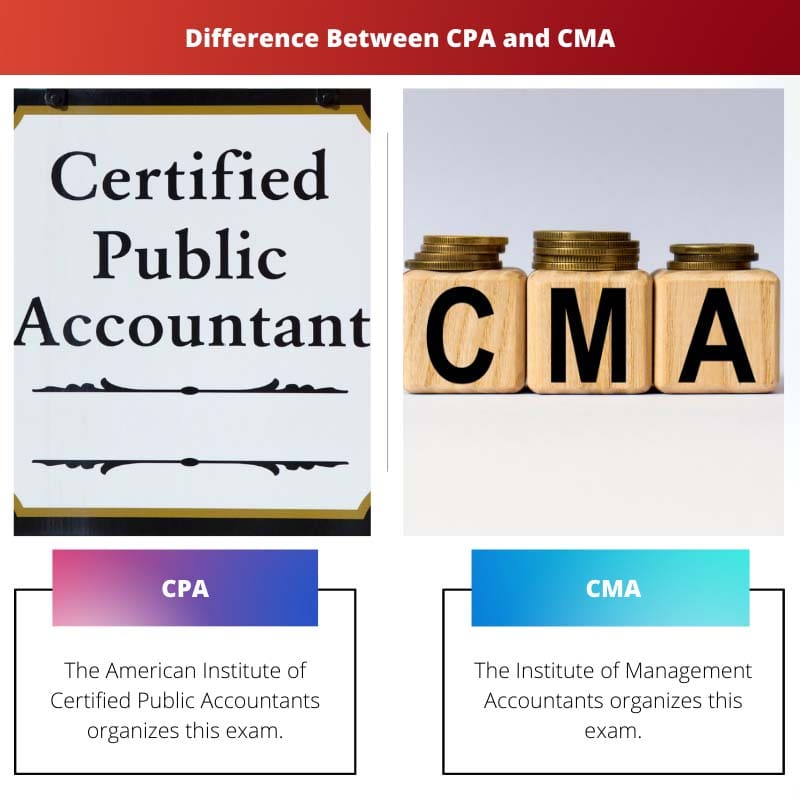

The certified public Accountants’ exam is organized by AICPA, which is the American Institute of certified public accountants. It is 18 months and can open gates to jobs like management accountant is considered a high-level post.

The exam fee for the Certified Public Accountants exam is 1500 dollars.

The certified management accountant exam is organized by the Institute of management accountants, which is IMA. It is a course that goes on for 3 years and can open a job field like cost accountant.

It is, however, a very hard exam and needs a lot of dedicated preparation. The exam fee for the Certified Management exam is 1000 dollars.

Comparison Table

| Parameters of Comparison | CPA | CMA |

|---|---|---|

| Organising Body | The American Institute of Certified Public Accountants organizes this exam. | The Institute of Management Accountants organizes this exam. |

| Duration of Course | The duration of the Certified Public Accountants examination course is 18 months. | The duration of the Certified Management Accountants examination course is 36 months. |

| Exam fees | The fee for this exam is 1500 dollars. | The fee for this exam is 1000 dollars. |

| Jobs | The jobs offered on clearing of the exam are Internet Auditor, Public Accountant, and Management Accountant. | The jobs offered on clearing of the exam are Consultant, Financial Risk manager, and Cost Accountant. |

| Difficulty | The rate of passing the exam to date is 50%. | The rate of passing the exam at present is 45%. |

What is CPA?

The CPA or certified public accountant exam is considered to be a very important competition for accounting students.

It is an exam with four sections: business environment and concepts, financial accounting and reporting audit and attestation, and regulation. The duration of this course is 18 months.

The eligibility to appear for the certified public accountant exam is to have a bachelor’s degree. CPA also requires at least two years of experience in public accounting.

Once certified, a public accountant must complete at least 40 hours every year of continuing education.

The certified public accountant exam is considered very difficult, and the passing exam rate is just 50%.

Its syllabus is sub-categorized into different parts: financial accounting and reporting, corporate governance, federal taxation, professional responsibilities, individual federal taxation, ethics and general principles, economic concepts and analysis, financial statement accounts, business environment and concepts, regulation, and audit and attestation.

The exam pattern also involves all these four sections similarly. The fee for this examination is $1500. Upon passing this examination, a CPA professional gets the opportunity of being a financial or accountant advisor.

What is CMA?

CMA or certified management accountants exam, is yet another important and physical examination that is dedicated to accounting students. It is a two-part examination held by the institutes of management accountants.

Part one of the exam is based on financial planning performance and analytics. Part 2 of the examination is based on strategic financial management.

An in-depth study of its syllabus requires at least thirty-six months of duration.

The syllabus involves a lot of topics ranging from decision analysis, cost management, performance management, planning, budgeting and forecasting, internal controls, financial statement analysis, and professional ethics.

Exam fees for certified management examinations are $1000, and the dates of examination are spread throughout the year. It is considered a very hard certification exam, and its passing rate is just 45%.

Expertise in interpreting and analyzing data is what a certified CMA personnel has to develop. This expertise of CMA professionals is needed in the improvement of business finance.

A candidate appearing for certified management accountants gets three years to clear both parts of the examination. This three-year duration starts from the registration day.

The eligibility to appear for the certified management accountant exam is to have a bachelor’s degree and two years of experience in financial management or management accounting. Also, 30 hours of continuing education is required by a CMA every year.

Main Differences Between CPA and CMA

- The American Institute of Certified Public Accountants organizes the CPA exam, whereas the Institute of Management Accountants organizes the CMA exam.

- The Certified Public Accountant course lasts 18 months, and that of Certified Management Accountants is 36 months.

- The Certified Public Accountant exam fee is 1500 dollars, and for Certified Management, Accountant is 1000 dollars.

- Internet Auditor, Public Accountant, and Management Accountant are the jobs offered after clearing the Certified Public Accountant exam. Consultant, Financial Risk Manager, and Cost Accountant are the jobs that are offered after clearing the Certified Management Accountant exam.

- The rate of passing the Certified Public Accountant exam is 50 %, while the rate of passing the Certified Management Accountant exam is 45%.

- https://search.proquest.com/openview/7eee1a7dcf9c325530ad2d96480eb0c0/1?pq-origsite=gscholar&cbl=3330

- https://search.proquest.com/openview/87eaa619824ceac8c9b27f64260f0d71/1?pq-origsite=gscholar&cbl=42470

Very informative and well-structured! It’s outstanding how the author has put together all the key information in such a concise and understandable manner.

Agreed, the comprehension and organization of aspects is commendable.

Perhaps due to the complexity of the content, the passing rates are so low.

Interesting to see how different the working fields are for both courses. It’s definitely something to consider when choosing which course to study.

Yes, it certainly provides a clearer insight into potential career paths.

I didn’t think CMA and CPA had such distinct differences – it’s almost like comparing apples and oranges!

The contrast is indeed quite striking!

One is a fruit, the other is a fruit – seems legit.

A very detailed overview. However, if the CMA exam is indeed harder, then why is the fee lower? Something seems to be off…

The rate of passing the exams is quite low. It would be interesting to know why that is.

The content seems to be exquisitely informative, packed with valuable information for prospective accounting students!