Different methods and rules exist for making a sophisticated balance sheet. These sheets need clear data that the accounts department can easily understand.

Companies and organizations use these methods for creating their final financial statements. And these financial statements show end-year or end-month profit or loss statements.

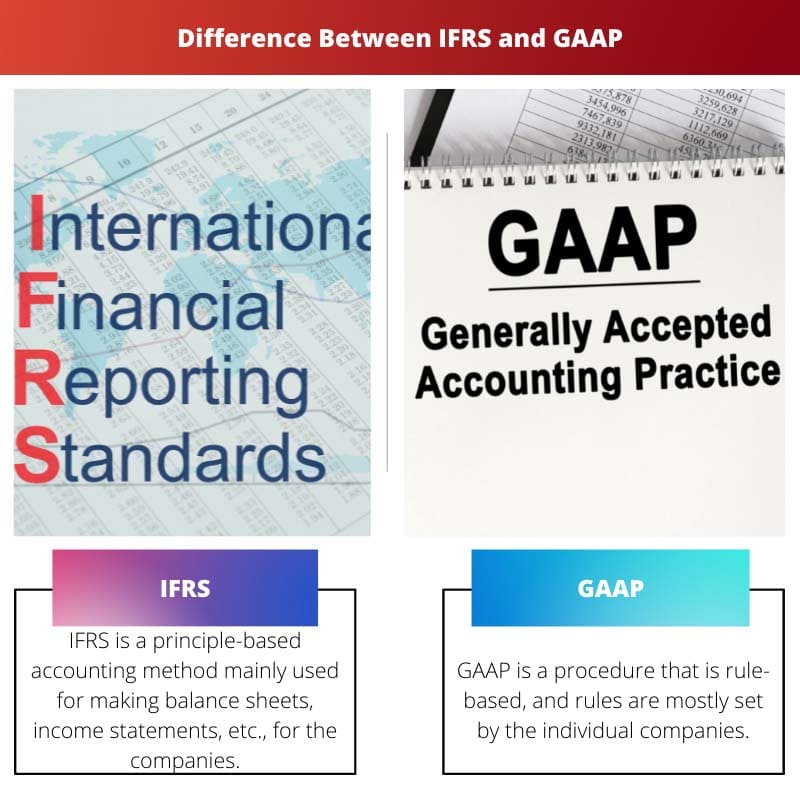

IFRS and GAAP are both accounting standards or methods with the help of which financial statements are made on a sheet.

Whereas IFRS is based on international guidelines or principles, and GAAP is more based on rules that can be set by the companies individually, and it may differ from company to company.

Key Takeaways

- IFRS is an international accounting standard used by over 120 countries, while GAAP is specific to the United States.

- IFRS is principles-based, allowing for more interpretation in applying the rules, whereas GAAP is rules-based with more detailed guidelines and requirements.

- Convergence efforts between IFRS and GAAP aim to create a unified global accounting standard, but significant differences exist in revenue recognition, inventory valuation, and lease accounting.

IFRS vs GAAP

IFRS was developed by the International Accounting Standards Board (IASB), which is an independent organization based in London. IFRS is a set of global accounting standards that are used in over 100 countries. GAAP was developed by the Financial Accounting Standards Board (FASB), which is a private organization based in the United States. GAAP is primarily used in the United States, but it is also used in some other countries.

IFRS is a method created by the international accounting standard board and is a principal-based standard. It is mainly used for reporting financial statements to companies.

This standard method is mostly used for making balance sheets, income statements, etc., understandably and clearly. The principles used cannot be changed.

GAAP is a procedure or rule set by the company and can be changed or differ from company to company. This is mostly a rule-based procedure.

This is created by the financial accounting standard board (FASB) to make income or financial statements more clear to people. It makes reports easy to compare.

Comparison Table

| Parameters of Comparison | IFRS | GAAP |

|---|---|---|

| Definition | IFRS is a principle-based accounting method mainly used for making balance sheets, income statements, etc., for the companies. It stands for the international financial reporting method. | GAAP is a procedure that is rule-based, and rules are mostly set by the individual companies. |

| Created by | It is created by the international accounting standard board or IASB. | It is created by the financial accounting standard board or FASB. |

| Significance | IFRS is an international standard principle that is followed by companies while making financial reports or income statements. | GAAP is a set of guidelines or rules set by the companies for making financial statements. |

| Based on | IFRS is totally principle-based standard and cannot be changed. | GAAP is a rule-based standard that can be altered according to tp companies’ needs. |

| Methods | It uses the weighted-average method and the first-in, first-out method. | It uses the weighted-average method and both last in, first out, and first-in, first-out method. |

| Items included | Items are not included in the final financial statement. | Items included are shown below in the statement issued. |

What is IFRS?

IFRS, or international financial reporting standards method, helps companies to set principles and rules in their financial statements. These principles and rules make financial statements consistent and clear.

IFRS principles are created by the international accounting standards board (IASB) to maintain equality in business.

IFRS assures that companies must have a common business language to maintain consistency and reliability. IFRS helps companies in gaining greater corporate control or transparency.

This method is used in making income statements, financial reports and balance sheets, etc. The reports generated through this method contain a summary of the company’s all transactions and operations.

IFRS uses the weighted-average method and the first-in, first-out method for making financial statements or reports. Many items are not shown in the final statement, unlike GAAP statements.

What is GAAP?

GAAP is used as an accounting method for making income, financial sheets, or reports. It stands for accepted accounting principles, and the principles included in this standard are given by or designed by the financial accounting standards board (FASB).

This method includes rules which can be modified.

GAAP creates clarity and understandability in a financial statement. GAAP also includes revenue recognition and materiality. The statements generated by using the GAAP method are easily comparable and also consistent.

It uses the last-in, first-out method or as an inventory cost method for making financial statements.

This method builds trust by providing a clear vision of the financial markets and helps investors analyze companies with comparable reports and clear statements. And it also includes extraordinary items which are not included in the IFRS method.

Main Differences Between IFRS and GAAP

- IFRS is a principle-based accounting method mainly used for making balance sheets, income statements, etc., for companies. It stands for the international financial reporting method. On the Other hand, GAAP is a rule-based procedure, and individual companies mostly set rules.

- GAPP uses the weighted-average method and both last-in, first-out, and first-in, first-out methods. In contrast, IFRS uses only the weighted average method and the first-in, first-out method.

- IFRS is a totally principle-based standard and cannot be changed. Whereas GAAP is a rule-based standard that can be altered according to tp companies’ needs.

- IFRS is an international standard principle that is followed by companies while making financial reports or income statements. In contrast, GAAP is a set of guidelines or rules set by companies for making financial statements.

- GAAP is created by the financial accounting standard board or FASB. Whereas IFRS is created by the international accounting standard board or IASB.

- https://meridian.allenpress.com/accounting-review/article-abstract/85/1/31/53738

- https://www.sciencedirect.com/science/article/pii/S0165410110000352

I appreciate the detailed comparison table. It gives a clear understanding of the differences and significance of IFRS and GAAP.

The comparison table is a great visual aid to understand the finer points of IFRS and GAAP. It really helps in decision-making.

Absolutely, having a clear understanding of these methods is important for anyone involved in financial management or reporting.

The explanations of IFRS and GAAP are insightful, providing a detailed comparison that contributes to a better understanding of financial reporting standards.

I agree, the article is a valuable reference for anyone looking to gain in-depth knowledge of IFRS and GAAP.

The detailed description of IFRS and GAAP is commendable, and it provides a deeper understanding of their application and significance in financial reporting.

Absolutely, the article is a great resource for professionals, students, and anyone interested in financial standards and reporting.

Great comparison between IFRS and GAAP. Both are important methods for making balance sheets and income statements.

The information provided is clear and concise, making it easier to comprehend the complexities of financial reporting standards.

Yes, it’s crucial for companies to understand the differences and choose the appropriate method for financial reporting.

The article provides a comprehensive overview of IFRS and GAAP, shedding light on their creation, significance, and methods of application.

I agree, it’s essential to have a clear understanding of these standards, especially for professionals working in accounting and finance.

The article provides a comprehensive comparison of IFRS and GAAP, shedding light on the differences in rules and principles adopted by these accounting standards.

Absolutely, the differences between IFRS and GAAP are crucial for professionals who need to ensure accurate financial reporting.

The article is an excellent resource for understanding the complexities of financial reporting standards and choosing the appropriate method.

The explanations of IFRS and GAAP are very clear and the examples provided make it easier to grasp the concepts.

I agree, the examples help in understanding the practical applications of these standards in financial reporting.

The comparison between the principle-based IFRS and rule-based GAAP is enlightening, and it’s interesting to note how they differ in methods and items included in financial statements.

Absolutely, understanding the nuances of each method is critical for accurate and reliable financial reporting.

The article effectively highlights the differences in the creation, significance, and methods of IFRS and GAAP, providing a comprehensive understanding of both standards.

The clarity of the explanations makes it easier to differentiate between IFRS and GAAP, which is crucial for financial decision-making.

Agreed, the article provides valuable insights for professionals working in accounting, finance, and business management.

The comparison of IFRS and GAAP is well-explained, and it helps in understanding the differences in principles and methods used for financial reporting.

I agree, the article is a valuable source of information for those seeking clarity on these accounting standards.