Leasing involves a longer-term commitment with fixed monthly payments, for assets like vehicles or real estate, and may include responsibilities like maintenance. Renting, on the other hand, is more short-term and flexible, involving payments for temporary use of property or goods without long-term obligations or ownership rights.

Key Takeaways

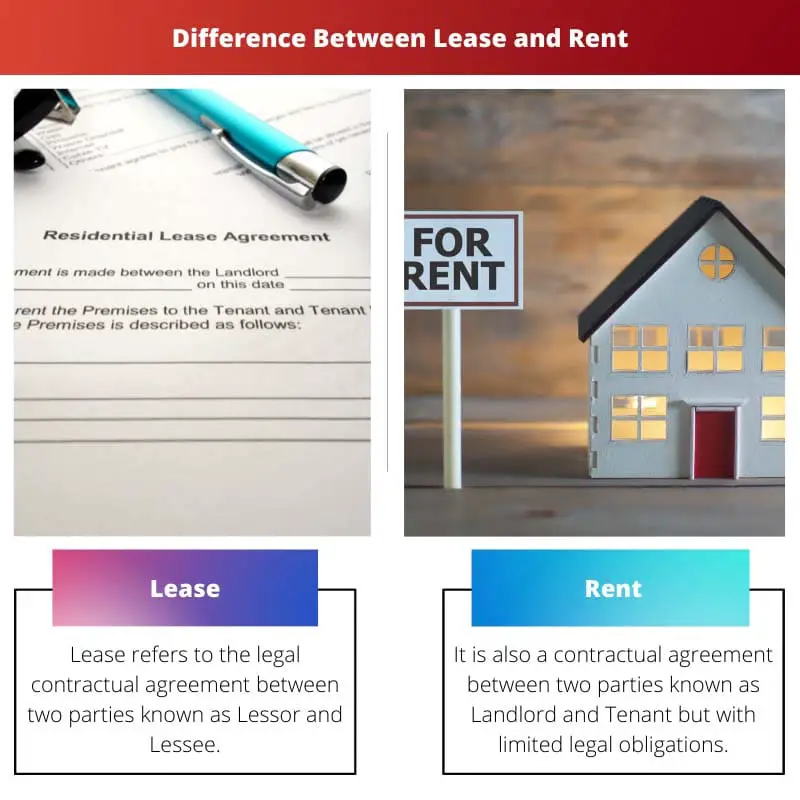

- A lease is a contractual agreement between a landlord and a tenant for a fixed period.

- Rent refers to the payment made by the tenant to the landlord for the use of a property.

- Lease agreements have longer durations than rental agreements.

Lease vs Rent

A lease is a contract between a landlord and a tenant for the use of a property for a set period of time, with specific terms and conditions. Rent is a periodic payment made for the use of a property, it is more flexible and only applies for a short period of time.

Comparison Table

| Feature | Lease | Rent |

|---|---|---|

| Term | Typically longer, ranging from 1 year to 3 years, with the option to renew. | Typically shorter, month-to-month, but can also be for fixed terms like 6 months. |

| Stability | Provides more stability and predictability in terms of housing costs. | Can be less stable as rent prices can fluctuate more frequently. |

| Flexibility | Less flexible as breaking a lease comes with penalties. | More flexible as you can move out with shorter notice (depending on the agreement). |

| Responsibilities | Tenant may be responsible for some minor maintenance and repairs in addition to rent. | Landlord handles most maintenance and repairs. |

| Potential for Ownership | In some cases, leases can include options to purchase the property at the end of the lease term (known as lease-to-own agreements). | Renting does not convey any ownership rights to the property. |

| Cost | Rent may be slightly lower than monthly payments on a comparable lease, but this can vary depending on the market and specific terms. | May offer lower upfront costs compared to a down payment on a mortgage. |

What is Lease?

A lease is a contractual agreement between two parties, the lessor (owner) and the lessee (user), granting the lessee the right to use an asset owned by the lessor for a specified period in exchange for periodic payments. Leases are prevalent in various industries, including real estate, automotive, equipment, and technology.

Components of a Lease

- Duration: The lease specifies the duration of the agreement, outlining the period during which the lessee has the right to utilize the asset. This can range from short-term leases, such as month-to-month arrangements, to long-term leases spanning several years.

- Terms and Conditions: The lease contract delineates the terms and conditions governing the arrangement. It includes details such as payment amounts, frequency of payments, responsibilities for maintenance and repairs, restrictions on use, and potential penalties for non-compliance.

- Payment Structure: The lease outlines the financial arrangements between the lessor and lessee. This encompasses the amount of periodic payments, whether fixed or variable, and any additional costs such as insurance, taxes, or maintenance fees.

Types of Leases

- Operating Lease: An operating lease is a short-term agreement where the lessee uses the asset for a portion of its useful life. It does not transfer ownership rights to the lessee and involves lower monthly payments compared to other lease types.

- Finance Lease: A finance lease, also known as a capital lease, resembles a loan arrangement where the lessee effectively purchases the asset over time. It covers a significant portion of the asset’s useful life, and the lessee may have the option to buy the asset at the end of the lease term at a predetermined price.

- Sale and Leaseback: In a sale and leaseback arrangement, a company sells its assets to a lessor and then leases them back for use. This strategy allows the company to unlock capital tied up in assets while retaining operational control and access to the asset.

Benefits of Leasing

- Conservation of Capital: Leasing enables businesses to conserve capital by avoiding large upfront payments associated with asset purchases, thereby preserving liquidity for other investments or operational needs.

- Flexibility: Leasing offers flexibility in asset management, allowing businesses to access the latest equipment or technology without committing to long-term ownership. It also facilitates scalability, enabling adjustments to lease terms or asset quantities as business needs evolve.

- Tax Advantages: Depending on the jurisdiction and the type of lease, businesses may benefit from tax advantages such as deductible lease payments or the ability to expense lease costs, enhancing overall financial efficiency.

What is Rent?

Rent refers to the payment made by a tenant to a landlord or property owner in exchange for the temporary use or occupancy of a property, asset, or item. Renting is a prevalent practice in the housing market, as well as in various other sectors such as equipment leasing, vehicle rentals, and machinery leasing.

Components of Renting

- Tenancy Agreement: A tenancy agreement, also known as a lease agreement or rental contract, outlines the terms and conditions of the rental arrangement. It includes details such as the duration of the tenancy, rental payments, security deposit requirements, maintenance responsibilities, and rules governing the use of the rented property.

- Payment Structure: Rent payments are made on a periodic basis, such as monthly, quarterly, or annually, as specified in the tenancy agreement. The amount of rent can vary based on factors such as the location, size, condition, and amenities of the property, as well as market demand and rental trends.

- Rights and Responsibilities: Both the landlord and the tenant have rights and responsibilities under the tenancy agreement. Landlords are responsible for maintaining the property in a habitable condition, adhering to building codes, and addressing any issues or repairs promptly. Tenants are responsible for paying rent on time, keeping the property clean and in good condition, and adhering to the terms of the lease.

Types of Renting Arrangements

- Residential Renting: Residential renting involves the temporary occupancy of housing units such as apartments, houses, condominiums, or townhouses. Tenants pay rent to the landlord in exchange for the right to live in the property for a specified period, under a lease agreement.

- Commercial Renting: Commercial renting pertains to the rental of non-residential properties such as office spaces, retail stores, warehouses, or industrial facilities. Businesses lease commercial properties to conduct their operations, and rental terms may vary based on factors such as location, size, zoning regulations, and lease duration.

- Equipment Rental: Equipment rental involves the temporary use of machinery, tools, vehicles, or other equipment for business or personal purposes. Renting equipment allows users to access specialized assets without the upfront costs of ownership, making it a cost-effective solution for short-term or occasional use.

Benefits of Renting

- Flexibility: Renting offers flexibility in terms of lease duration, allowing tenants to adjust their living or business arrangements according to changing needs or circumstances without the long-term commitment associated with property ownership.

- Maintenance and Repairs: In many rental agreements, landlords are responsible for property maintenance and repairs, relieving tenants of the financial and logistical burdens associated with property upkeep.

- Lower Upfront Costs: Renting requires lower upfront costs compared to purchasing or financing assets outright, making it an accessible option for individuals or businesses with limited capital or credit.

Main Differences Between Lease and Rent

- Ownership Rights:

- In a lease, the lessee (tenant) gains exclusive rights to use the asset for a specified period but does not own it.

- In renting, the tenant has temporary use of the property or asset but does not acquire any ownership rights.

- Duration and Flexibility:

- Leases involve longer-term commitments, spanning months or years, with fixed terms and conditions.

- Renting tends to be more short-term and flexible, allowing for month-to-month or periodic arrangements without long-term obligations.

- Financial Responsibility:

- In a lease, the lessee bears responsibility for maintenance, repairs, and sometimes insurance costs.

- Renting shifts maintenance and repair responsibilities to the landlord or owner, relieving the tenant of these financial burdens.

- Purpose and Usage:

- Leases are commonly used for accessing assets like real estate properties, vehicles, or equipment for business or personal use.

- Renting encompasses a broader range of assets and properties, including residential and commercial spaces, equipment, vehicles, and other tangible goods.

The article does a great job of dissecting the key components of a lease and the implications of renting. It’s insightful and well-structured, providing a comprehensive understanding of the topic.

Absolutely. It’s a great reference for anyone navigating the decision to lease or rent.

I totally agree. The comparison table makes it easy to differentiate between the two arrangements.

The breakdown of lease types and the termination and renewal section provide valuable insights into the nuances of lease agreements. This article is incredibly helpful in clarifying these concepts.

I found the section on cost predictability and financial implications very informative. It offers a comprehensive understanding of the financial aspects of leases.

Absolutely. This article provides a comprehensive overview of these crucial considerations.

I appreciate the distinction made between residential, commercial, and equipment leases. It clarifies the different contexts in which leases are utilized.

Agreed. The legal implications and responsibilities are also thoroughly explained.

This article provides a comprehensive breakdown of the differences between leasing and renting, as well as the legal implications involved. It’s an incredibly informative piece that could help many individuals make the right decision for their circumstances.

Absolutely. The breakdown between residential, commercial, and equipment leases is particularly helpful.

I couldn’t agree more. The detailed comparisons and key components of a lease really shed light on the topic.

I found the section on stability and cost predictability to be very informative. It’s crucial to understand the financial implications of leasing versus renting.

Absolutely, understanding the upfront costs and cost predictability is essential when making decisions about property agreements.

Definitely. This article provides a comprehensive overview of these important considerations.

The article is very thorough in outlining the differences between lease and rent, providing in-depth details on each aspect. It’s an excellent resource for anyone looking to understand these concepts.

I couldn’t agree more. The breakdown between leases and stability versus flexibility is presented very clearly.

The detailed comparison table and the explanation of the key components of a lease provide a thorough understanding of the topic. It’s an excellent resource for anyone looking to grasp the differences between leasing and renting.

I couldn’t agree more. The breakdown between lease and rent is incredibly well-presented.

The article creatively dissects the intricacies of lease and rent, providing a comprehensive understanding of the topic. It’s a valuable resource for anyone looking to make informed decisions about property agreements.

I found the section on costs and responsibilities to be particularly enlightening. It provides a clear overview of the financial and maintenance aspects of these agreements.

The section on the legal implications of leases is particularly intriguing. It reminds us of the importance of understanding the legal framework of these agreements.

Absolutely. This aspect is overlooked, but it’s crucial to consider the legal complexities of lease contracts.

The article provides a clear understanding of the various types of leases and their implications. The comparison table is especially useful in highlighting the key differences between leasing and renting.

I found the section on termination and renewal very insightful. It’s important to know the conditions for ending or extending a lease.