Money and currency are closely connected. They almost seem to be the same. These two terms are used by people in everyday life.

Key Takeaways

- Money is a broader concept encompassing any medium of exchange, store of value, and unit of account.

- Currency refers to physical tokens or notes, like coins and bills, representing a specific country’s money.

- Currency values fluctuate due to economic conditions, political stability, and market demand.

Money vs Currency

Money is a general term for any form of payment or exchange of value, which is anything that can be used to purchase something. Currency is a type of money that is issued and backed by a government, and it is a standardized medium of exchange that is widely recognized and accepted as a means of payment.

Money serves as a medium of exchange. It enables its holders to buy and sell goods and services all around the world.

Currency is a form of money, such as the rupee, euro, or dollar, accepted as a mode of payment. It is money in circulation or money traded publicly.

Comparison Table

| Parameters of Comparison | Money | Currency |

|---|---|---|

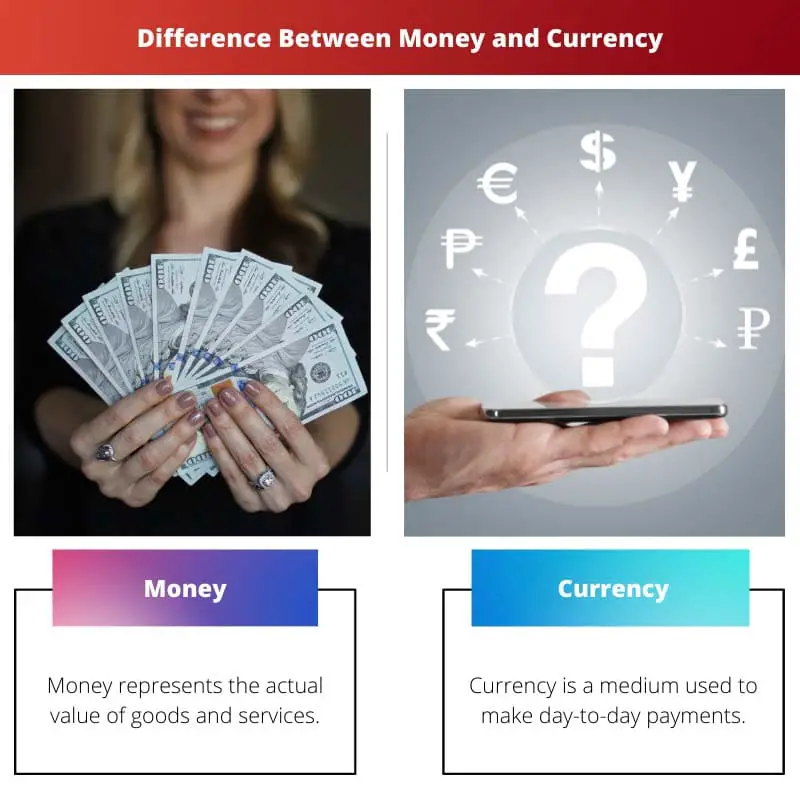

| Uses | Money represents the actual value of goods and services. | Currency is a medium used to make day-to-day payments. |

| Store of value | It serves as a store of value. | It is just used to make transactions. |

| Tangibility | It is intangible, i.e., it cannot be seen or touched. | It is tangible i.e., it can be seen as well as touched like paper notes and coins. |

| Functions | It performs mainly four functions: medium of exchange, store of value, measure of value, and standard of deferred payments. | It performs the function of financing day-to-day transactions. |

| Examples | Some of its examples are money in the bank(saving account, fixed deposit account), plastic money like credit cards, etc. | Its examples are paper notes(soft money) and metal coins(soft money). |

What is Money?

Money, also called Legal tender money, serves as a medium of exchange of goods and services in the economy. It serves as a means of payment.

- Medium of exchange: Money serves as a medium of exchange. Medium of exchange means that a buyer can purchase the goods and services, and the seller can sell the prospective goods and services.

- Store of value: Money has purchasing power which essentially means that it can cater to future needs. It is used as a store of value or wealth.

- The measure of value: The introduction of money solved the problem of the barter system, where it was difficult to calculate the value of a good based on other goods.

- Standard of deferred payments: Money can be used for making future payments. This function of money led to the foundation of financial institutions.

Money is the basis of survival, freedom, and financial security.

What is Currency?

Currency is used to describe ‘money in circulation. It refers to money held by people in the form of soft money like paper notes and hard money like coins.

Currency has been in circulation for more than a thousand years. It facilitates trade across different countries. US Dollars are regarded as the most widely accepted currency in the world.

Foreign Exchange(FOREX) provides a platform to facilitate the exchange of national currencies. It creates a system of buyers and sellers who wish to trade the currencies and earn profit.

Recently a new kind of currency has been introduced in the economy called virtual currency. The virtual currency has no physical existence or government backing.

Main Differences Between Money and Currency

- Money cannot lose its buying power. On the other hand, currency may lose its power due to some RBI or government regulations.

- Money functions as a store of wealth, whereas currency is used to finance transactions without making the addition of one’s wealth.

The elucidation of money as a medium of exchange and store of value, and currency as a mode of payment, offers a comprehensive understanding of their roles within the financial ecosystem. The distinction between money and currency is adeptly captured in this article.

The comprehensive analysis and meticulous comparison between money and currency are truly enlightening. The distinctions and functions of money and currency, elaborated in the article, offer a profound understanding of these essential financial components.

Agreed. The comprehensive breakdown of money and currency, highlighting their distinct functions and examples, provides a profound analysis of their intrinsic differences. The article encapsulates the essence of money and currency with clarity.

The article provides a comprehensive understanding of money and currency. The detailed exploration of their functions and tangibility, along with the examples and references, offers a profound analysis of these financial elements, enabling a comprehensive grasp of their distinctions.

The comprehensive analysis of money and currency, elucidating their functions and examples, is truly enlightening. The article provides a profound understanding of their distinctions within the economic landscape, offering valuable insights into these integral financial components.

Absolutely. The article’s in-depth analysis of money and currency offers a comprehensive understanding of these fundamental financial elements. The elucidation of their functions, examples, and tangible aspects provides valuable insights into their pivotal roles.

Agreed. The thematic breakdown of money and currency, along with the comprehensive comparison table, provides an insightful perspective on their intrinsic differences. The article adeptly highlights the distinctions between money and currency.

The comprehensive exploration of money and currency, along with the detailed comparison table, offers a profound understanding of their functional differences. The article adeptly elucidates the intrinsic distinctions between money and currency, providing valuable insights into these pivotal financial elements.

Precisely. The detailed analysis of money and currency, framed within the comparison table, provides an insightful perspective on their functional differences and intrinsic roles within the financial system. The article offers a comprehensive understanding of these essential financial components.

Agreed. The thorough articulation of the differences and functions of money and currency, elucidated within the comparison table, offers an insightful perspective on their intrinsic roles within the economic landscape. The article provides a comprehensive analysis of these pivotal financial elements.

The article meticulously articulates the nuances between money and currency, emphasizing their distinctive roles within the economic landscape. It provides a comprehensive overview of the broader concept of money and the specifics of currency, facilitating a deeper understanding of these integral financial aspects.

The comprehensive overview of money and currency provided in the article sheds light on their distinct functions and tangible aspects. The detailed analysis and elucidation of the intrinsic differences between money and currency are truly enlightening.

Absolutely. The article adeptly captures the essence of money and currency, accentuating their functions, examples, and intrinsic differences. It provides a comprehensive understanding of these fundamental financial aspects with clarity.

Precisely. The detailed comparison between money and currency, along with their distinct functions and examples, provides a profound analysis of these pivotal financial elements. The article offers an insightful perspective on the intrinsic differences between money and currency.

The article’s overview of money and currency captures their intrinsic differences aptly. The detailed analysis and comparison table provide a profound understanding of the functional roles of money and currency within the financial system, offering comprehensive insights into these essential financial components.

Absolutely. The article meticulously articulates the nuances between money and currency, accentuating their intrinsic differences and functional roles within the economic landscape. It provides a comprehensive overview of these integral financial aspects.

This article provides a thorough comparison between money and currency, delving into the intrinsic differences between the two. It has elucidated how money is a broader concept and encompasses the functions of store of value and unit of account, while currency is confined to physical tokens or notes representing a specific country’s money.

I concur. The article has succinctly explained the distinction between money and currency, shedding light on their functionalities and tangible aspects. The comparison table provides a clear overview of the parameters and examples of money and currency.

Agreed. The elucidation of the key takeaways and the in-depth analysis of money as a medium of exchange and currency as a mode of payment truly accentuates the comprehensive understanding of the subject matter presented in this article.

The delineation of money and currency in the article is truly comprehensive and informative. The underlying functions and examples of money and currency, aptly conveyed in the comparison table, provide a profound understanding of these fundamental financial components.

Precisely. The thorough analysis of money as a broader concept encompassing exchange, value, and a unit of account, along with the specifics of currency as physical tokens representing money, elucidates the intricate differences meticulously.

The comparison table and the comprehensive overview of money and currency are enlightening. The distinct functions and examples of each elucidate their individual roles within the financial system. An insightful analysis of the intrinsic differences between money and currency.

Absolutely. The detailed explanation of the functions and tangibility of money and currency provides a comprehensive understanding of their significance. The article adeptly captures the essence of money and currency, offering in-depth insight into their pivotal roles.