An overdraft is a credit facility allowing account holders to withdraw more money than their balance, subject to a limit. A cheque is a written order from an account holder to a bank to pay a specific amount to the recipient, drawing funds from the account. While overdraft provides flexibility, cheques facilitate direct fund transfers through written instructions.

Key Takeaways

- An overdraft is a banking facility that allows account holders to withdraw more money than they have in their account up to a predetermined limit. At the same time, a cheque is a written document instructing a bank to pay a specific amount to a designated recipient.

- Overdrafts help account holders manage temporary cash flow issues by providing access to additional funds, while cheques facilitate the transfer of funds between accounts without the need for cash.

- Overdrafts come with interest charges or fees for the borrowed amount, while cheques may involve minimal or no fees, depending on the bank and type of account.

Overdraft vs Cheque

The difference between Overdraft and Cheque is that an Overdraft allows you to withdraw more money than the current balance in your savings account. In contrast, Cheque lets you remove the amount specified in the paper (within your account balance).

An overdraft allows you to withdraw money even when your account balance reaches zero. To say it is a kind of small loan with interest.

The cheque has an entirely different sense. It is a document that orders the bank to pay a certain amount of money in whose name the cheque is written.

It does not let you withdraw more than the account balance.

Comparison Table

| Feature | Overdraft | Cheque |

|---|---|---|

| Definition | Borrowing money from a bank to cover insufficient funds in a checking account | A written order to a bank to pay a specified amount of money from the drawer’s checking account to the payee |

| Initiation | Occurs automatically or with approval (depending on bank policy) when a transaction exceeds available funds | Written and signed by the drawer and presented to the payee or deposited for payment |

| Payment source | Bank credit extended to the account holder | Account holder’s own funds |

| Interest | Charged on the borrowed amount, with high daily rates | No interest charged (unless cheque bounces) |

| Fees | Often includes overdraft fees and non-sufficient funds (NSF) fees | May incur stop-payment fees or returned cheque fees |

| Risk | Can lead to debt and financial difficulties if not managed responsibly | No inherent risk to drawer, but bouncing cheques can harm reputation and incur fees |

| Control | Limited control once used; repayment required | Full control over when and how the payment is made |

| Suitability | For unplanned short-term emergencies | Planned payments to individuals or businesses |

| Availability | Requires bank approval and may have limits | Widely available to account holders |

What is Overdraft?

An overdraft is a financial arrangement that allows an account holder to withdraw or spend more money than is currently available in their account, essentially providing a short-term line of credit. It is commonly offered by banks and financial institutions to account holders to manage temporary financial shortfalls.

Key Features of Overdraft:

- Credit Limit: The bank sets a specific credit limit for the overdraft, which represents the maximum amount that can be overdrawn. This limit is determined based on the account holder’s creditworthiness and financial standing.

- Interest Charges: Interest is charged only on the amount overdrawn and for the duration it remains outstanding. The interest rate is higher than that of standard loans, making it important for account holders to manage their overdraft efficiently.

- Flexibility: Overdrafts provide flexibility by allowing account holders to access additional funds when needed. It is a useful financial tool for managing unexpected expenses or bridging short-term gaps in cash flow.

- Repayment Terms: Overdrafts are payable on demand, and the account holder is required to bring the account back to a positive balance within a specified period. Repayment terms may vary, and failure to adhere to them may result in additional fees or the withdrawal of the overdraft facility.

- Approval Process: The approval of an overdraft is subject to the bank’s assessment of the account holder’s creditworthiness. Factors such as income, credit history, and relationship with the bank play a crucial role in determining the eligibility and limit of the overdraft.

What is Cheque?

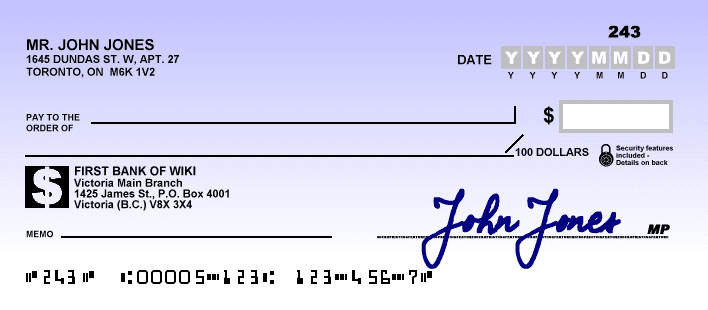

A cheque is a financial instrument used for making payments, providing a secure and widely accepted method of transferring funds between individuals and businesses. It serves as a written order from an account holder (drawer) to their bank (drawee) to pay a specific sum of money to the named recipient (payee).

Cheque Components

- Drawer: The individual or entity writing the cheque, directing the bank to make a payment.

- Drawee Bank: The bank where the drawer holds the account from which the funds will be withdrawn.

- Payee: The person or entity to whom the cheque is payable and who receives the funds.

- Amount: The numerical and written representations of the sum to be paid.

- Date: The date when the cheque is issued, indicating when the payment should be made.

- Signature: The drawer’s signature, ensuring authorization and security.

Types of Cheques

- Bearer Cheque: Payable to the bearer, enabling anyone holding the cheque to receive payment.

- Order Cheque: Payable to a specific person or entity, requiring endorsement for transfer.

- Crossed Cheque: Contains two parallel lines across its face, indicating that the funds should be paid into a bank account rather than being cashed.

Cheque Clearing Process

- Deposit: The payee deposits the cheque into their bank account.

- Presentment: The cheque is sent to the drawee bank for payment.

- Clearance: The drawee bank verifies the funds, and if available, the cheque is cleared for payment.

- Settlement: The funds are transferred from the drawer’s account to the payee’s account.

Importance and Limitations

Cheques offer a secure and traceable means of payment but may have processing delays. With the advent of electronic payment methods, cheques are less commonly used, yet they remain relevant in certain financial transactions.

Main Differences Between Overdraft and Cheque

- Nature:

- Overdraft is a credit facility allowing account holders to withdraw more money than their balance, up to a predetermined limit.

- Cheque is a written order from an account holder to a bank, directing it to pay a specific amount to the named recipient.

- Functionality:

- Overdraft provides flexibility by allowing account holders to temporarily exceed their account balance, useful for managing short-term cash flow needs.

- Cheque facilitates direct fund transfers through a written instruction, serving as a secure method for making payments to a specific payee.

- Usage:

- Overdraft is utilized to cover temporary financial shortfalls or unexpected expenses.

- Cheque is employed for various payment purposes, including settling bills, making purchases, or transferring money to specific individuals or businesses.

- Authorization:

- Overdraft requires pre-approval from the bank and is subject to a predetermined credit limit.

- Cheque issuance requires the account holder’s authorization through a written signature on the cheque.

- Transaction Type:

- Overdraft is a credit transaction, allowing account holders to temporarily borrow funds beyond their actual account balance.

- Cheque represents a payment order, directing the bank to transfer funds from the drawer’s account to the payee.

- Medium:

- Overdraft is a financial arrangement linked to the account and may not involve physical documents.

- Cheque involves a physical document (the cheque itself) that serves as the payment instrument.

- Costs:

- Overdraft may involve interest charges and fees, particularly if the credit limit is exceeded.

- Cheque usage does not incur direct costs for the drawer, but the bank may charge fees for services related to cheque processing.

- https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.kluwer/erpl0018§ion=92

- https://academic.oup.com/rfs/article-abstract/27/4/990/1603971

Last Updated : 11 February, 2024

Chara Yadav holds MBA in Finance. Her goal is to simplify finance-related topics. She has worked in finance for about 25 years. She has held multiple finance and banking classes for business schools and communities. Read more at her bio page.

The approval process for an overdraft is interesting – the assessment of creditworthiness, income, and credit history makes it clear that it’s not a decision to be taken lightly. I appreciate the detailed explanation of the key features.

I agree, Carter Lauren. The post does an excellent job of breaking down the approval process and repayment terms of overdrafts, providing crucial insights for potential users.

This detailed overview highlights the importance of understanding the implications of using an overdraft. It’s a financial decision that requires careful consideration.

I find the comparison between overdrafts and cheques fascinating. The post effectively highlights the key differences, making it easier for individuals to weigh the pros and cons of each financial facility.

The detailed explanation of the suitability and availability of overdrafts and cheques is particularly insightful. It’s crucial for individuals to understand the contexts in which these financial tools are most appropriate.

Absolutely, Ethan99. The detailed comparison table provides a comprehensive breakdown of the features of overdrafts and cheques, enabling individuals to make informed decisions based on their financial needs.

The detailed features of an overdraft and a cheque are very well explained in this post. It provides valuable insights into the risks, suitability, and availability of these financial tools.

I agree, Reynolds Tim. The nuanced comparison helps individuals gain a comprehensive understanding of overdrafts and cheques, allowing for informed decision-making in managing their accounts.

Absolutely, the post effectively breaks down the key features and risks associated with overdrafts and cheques, making it easier for account holders to navigate their financial options.

An overdraft seems like a risky option – with high interest rates and the potential to lead to debt if not managed responsibly. I’d much rather stick to using cheques for planned payments.

I personally find cheques more reliable, especially for planned payments. The post provides a clear understanding of the differences and implications of both overdrafts and cheques.

I understand your concern, Noah41. It’s crucial for individuals to be aware of the risks associated with overdrafts and consider all available options before deciding on a financial tool.

The post provides valuable insights into the risk and benefit comparison between overdrafts and cheques. It’s crucial for account holders to have a comprehensive understanding of these financial tools when managing their funds.

Absolutely, Charlotte92. Managing one’s finances effectively requires a clear understanding of the implications of opting for an overdraft or using cheques for fund transfers.

The detailed explanation of the features of overdrafts and cheques helps demystify these financial tools, allowing account holders to make informed decisions about their usage.

This post succinctly explains the key differences between overdrafts and cheques. The comparison table is particularly helpful in understanding the various features and risks associated with each financial tool.

Very informative post, the key takeaways quickly summarize the differences between an overdraft and a cheque. Both facilities have their uses and it’s important for account holders to understand their features and implications.

I appreciate the detailed comparison table that highlights the key differences between overdraft and cheques. It’s a handy reference for anyone seeking to grasp the nuances of these facilities.

Absolutely, having a clear understanding of these financial tools can help individuals make informed decisions about managing their funds.

The risk and control comparison breakdown of overdrafts and cheques is extremely enlightening. This post serves as an essential resource for individuals looking to understand the implications of these financial tools.

Absolutely, Xtaylor. A clear understanding of the risks, control, and implications of utilizing overdrafts and cheques is crucial for prudent financial management.

This post effectively breaks down the risks and control aspects of overdrafts and cheques, empowering individuals to approach their financial decisions with greater clarity and knowledge.

The comprehensive breakdown of the key features, eligibility, and implications of overdrafts and cheques in this post is highly valuable. It equips account holders with the knowledge to make prudent financial decisions.

I find the detailed explanations of the initiation, payment source, and control over overdrafts and cheques particularly enlightening. This post serves as an invaluable guide for account holders.

Indeed, Harrison Rebecca. The detailed comparison table and explanations help demystify the complexities of overdrafts and cheques, empowering individuals to manage their finances more effectively.

The comprehensive overview of the key features of overdrafts and cheques is highly valuable. It equips readers with the knowledge to make informed decisions about utilizing these financial tools.

I agree, Fred Campbell. The post presents a clear and detailed comparison of the essential elements of overdrafts and cheques, enabling individuals to navigate their financial options with clarity.

The detailed comparison and breakdown of the features of overdrafts and cheques is enlightening. It’s an essential read for anyone seeking to enhance their understanding of financial tools.