The backbone of the modern economy is the banking system. It is one such financial institution on which almost all individual and business entity depends. Banking institutions worldwide offer various monetary arrangements for easy financial transactions.

Overdraft and Demand draft are two features that most banks worldwide offer. Many economic activities become possible with these two monetary services.

Key Takeaways

- An overdraft is a credit facility a bank provides that allows account holders to withdraw more money than they have in their account. At the same time, a demand draft is a financial instrument used to transfer funds from one bank account to another.

- Overdrafts are a form of short-term credit that must be repaid with interest, while demand drafts are a secure and pre-paid method of transferring money, requiring the payer to deposit the funds upfront.

- Overdrafts are linked to a specific bank account and can be used repeatedly, whereas demand drafts are single-use instruments that must be issued for each transaction.

Overdraft vs Demand Draft

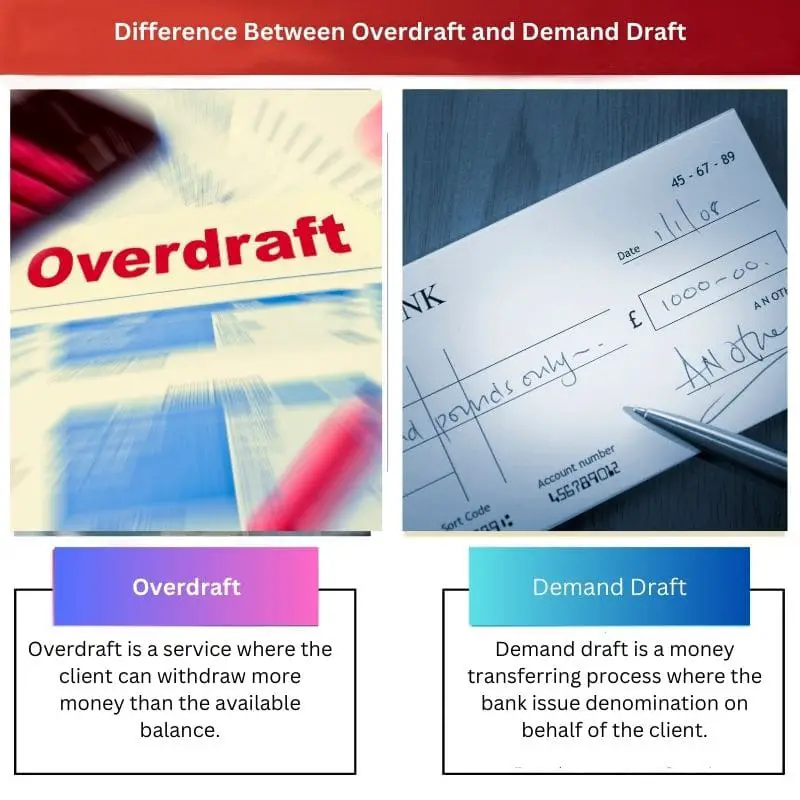

The difference between an Overdraft and a Demand Draft is that an Overdraft is a credit facility the bank provides to the customers. They can withdraw or deposit an amount without a per-day limitation and restriction. Demand Draft is a process to transfer money, in which the bank issues a draft on a customer’s request for a third party.

Comparison Table

| Parameter of Comparison | Overdraft | Demand Draft |

|---|---|---|

| Overview | Overdraft is a service where the client can withdraw more money than the available balance. | Demand draft is a money transferring process where the bank issue denomination on behalf of the client. |

| Eligibility | Eligibility for the overdraft feature depends on the relationship between the bank and the client. | Everyone is eligible for the demand draft. |

| Credit score | The client must have a good credit score. | Anyone with any credit score can apply for the issuance of a demand draft. |

| Fees | Fixed annual or quarterly payments for overdraft service. | The charge that applies to the demand draft depends on the amount. |

| Types | standard overdraft and secured overdraft | Sight demand draft and Time demand draft. |

What is Overdraft?

Overdraft is a facility bank gives to their loyal clients to withdraw more money than what the account holders have in their bank account. Through this financial instrument, the bank can increase the monetary limit of a customer.

A client with a strong credit score gets more overdraft limit than someone with a low credit score. An overdraft is a short-term credit limit where the client has to return the money within repayment tenure.

However, the overdraft feature is optional; the client can stop this feature at any time. The client also has to pay additional interest and fees for late repayment.

An overdraft can be taken against savings accounts, salary accounts, and time deposits. There are two types of overdrafts available in most banks.

What is Demand Draft?

A demand Draft is a monetary arrangement in which the bank guarantees payment of a certain amount to the payees. In any situation, the payee’s name cannot be changed, and the price cannot clear through anyone else’s account.

For this reason, it is not possible to dishonour a demand draft. Due to this reason, most financial institute prefers payment through demand draft.

The payee can get a demand draft by depositing cash or a cheque to the bank. There are two types of demand drafts “Sight demand draft” and “Time demand draft”.

Most demand drafts with a small amount of money can be encashed without a bank account. However, if the amount exceeds a specific limit, the receiver or drawer must encash it through a bank account.

Main Differences Between Overdraft and Demand Draft

- Overdraft is a service given to specific few clients of the bank; with this service, the bank can withdraw more than the available balance. The demand draft is a monetary arrangement of the bank by which anyone can securely transfer money to a specific person or entity.

- Someone with a good credit score is eligible for the overdraft. However, anyone can request the bank to demand draft issuance.

This is all very basic financial information. It would be nice to dig deeper into some more complex topics.

I understand, but the basics are always important for those learning about these topics for the first time.

I found this article very enlightening and knowledgeable. Thank you.

You’re welcome. I completely agree. It’s important to understand these banking fundamentals.

I appreciate the detailed comparison between overdrafts and demand drafts. Very useful information.

Yes, I found the side-by-side comparison to be particularly helpful in discerning the differences.

Absolutely, it’s a great way to understand the distinctions between the two financial services.

This post is just stating the obvious. I was expecting new insights.

I understand what you’re saying, but it’s always good to have a refresher on the basics.

I agree, sometimes it’s good to cover the basics for those who may not be familiar with them.

The comparison table is a great way to summarize the key points about overdrafts and demand drafts.

Agreed, the table is very helpful for quick reference.

Definitely, a very clear and concise way to showcase the differences.

I appreciate the details provided in this article. It’s really helpful.

The in-depth comparison of overdraft and demand draft was quite insightful.

Yes, there’s a lot of valuable information here. Great read.

I was already familiar with this information. I was expecting something more advanced.

That’s understandable. Sometimes the basics can serve as a good refresher for some readers.

Agreed, and for those who are not yet familiar with overdrafts and demand drafts, this is very helpful.

This post effectively communicated the differences between overdrafts and demand drafts. Well done.

Agreed, it’s valuable information that’s clearly presented.

Absolutely, the clarity of explanation was certainly commendable.

The details and explanation provided are excellent. It makes the topic very clear.

I couldn’t agree more. This article really breaks down the concepts well.

The information provided was quite comprehensive. I appreciate that.

Absolutely, it covered everything one needs to know about overdraft and demand drafts.