Before starting a stock market venture, investors must first grasp the words “stocks” and “shares.” The words are, even so, interchanged.

To some degree, they refer to the same thing: an individual’s stock ownership in a public corporation. While the term stock refers to a share of ownership in one or more businesses, the term share has a more precise connotation.

A single company’s ownership unit is referred to as a share.

Key Takeaways

- Stocks represent ownership in a company, while shares represent a unit of ownership.

- Stocks are traded on stock exchanges, while shares can be traded privately or publicly.

- Stocks provide higher returns than shares due to the potential for capital appreciation and dividends.

Stocks vs Shares

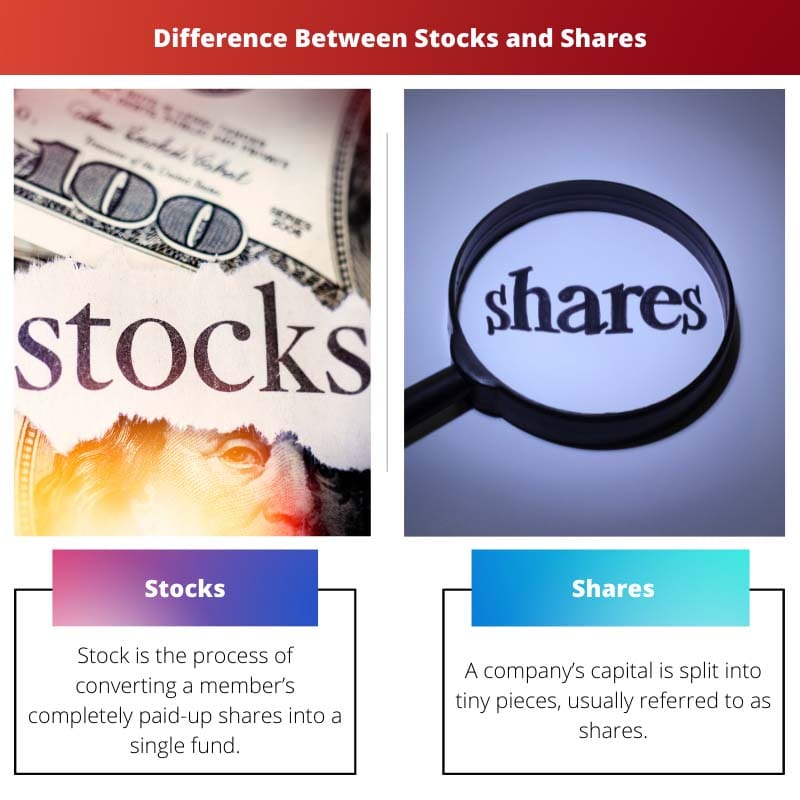

The difference between Stocks and Shares is that the A ‘Share’ is the smallest unit of the company’s capital, and it represents the ownership of the company’s shareholders. A ‘Stock,’ on the other hand, is a collection of a member’s paid-up shares. When shares are converted into stock, the shareholder becomes a stockholder who has the same rights as a shareholder in terms of dividends.

When a business needs to obtain funds, it may either issue shares or try to borrow money. They are the securities that represent a portion of the corporation’s ownership.

Some stocks pay dividends, which represent a part of the issuing company’s profits, on a monthly, quarterly, or yearly basis.

When someone says they own “stocks,” they may be referring to a single company’s stock or a portfolio of businesses.

When a company issues stock, each of the stock’s units is referred to as a share. Consequently, one share of stock represents one unit of ownership in a business. Shares are the owners of the business.

When someone says they hold “shares” in a business, they are referring to stock that represents a proportion of the entire equity of the company.

Comparison Table

| Parameters of Comparison | Stocks | Shares |

|---|---|---|

| Definition | Stock is the process of converting a member’s completely paid-up shares into a single fund. | A company’s capital is split into tiny pieces, referred to as shares. |

| Definite number | Such a number does not exist in stock. | A unique number is a specific number assigned to a share. |

| Nominal value | No | Yes |

| Paid-up value | Stock can only be fully paid up. | Partially or completely paid-up shares are available. |

| Denomination | Unequal amounts | Equal amounts |

What are Stocks?

A share is the smallest division of a company’s share capital that reflects the percentage of ownership held by the company’s shareholders. The shares serve as a link between the business and its shareholders.

To raise money for the business, the shares are offered for sale on the stock market or other marketplaces.

The shares are movable property that may be transferred in accordance with the company’s Articles of Association. There are two main types of stocks: equity and preferred stock.

Preference shares have preferential rights for dividend payments and capital repayment in the event of the company’s winding up.

Equity shares are the company’s common shares with voting rights, whereas preference shares have preferential rights for dividend payment and capital repayment in the event of the company’s winding up.

A company’s shares may be issued in one of three ways: Par, Premium, or Discount.

What are Shares?

A stock is just a collection of a company’s member’s shares in one lump payment. Stock is created when a member’s shares are combined into a single fund.

The fully paid-up shares of a public corporation limited by shares may be converted into stock. The initial issuance of shares, however, is not feasible.

The following requirements must be met in order for the shares to be converted into stock: Such a conversion should be specified in the articles of incorporation.

At the company’s Annual General Meeting (AGM), an Ordinary Resolution (OR) should be passed.

Within the timeframe specified, the business must notify the ROC (Registrar of Companies) of the conversion of shares into stock.

Succeeding the conversion of shares to stock, each member’s stock will be shown in lieu of their shares in the company’s register of members. However, there should be no changes to the members’ voting rights.

Furthermore, there is no impact on the transferability of stock. They can now be transmitted as fractions. There are two kinds of stock: common and preferred.

Main Differences Between Stocks and Shares

- A share is the smallest unit of the company’s share capital that represents the shareholder’s ownership. Stock, on the other hand, refers to a collection of a member’s shares in a corporation.

- A share has a specific number that differentiates it from other shares, known as a distinctive number, while stock does not.

- The stock does not have any nominal value, while the shares do.

- Partially paid or fully paid shares are available. Stock, on the other hand, is always paid in full.

- Someone who owns stocks may have two distinct stocks with different values; someone who has shares in a business could have several shares with the same or equal value.

- https://academic.oup.com/rfs/article-abstract/3/2/255/1595700

- https://www.sciencedirect.com/science/article/pii/S0378437120300078

The distinction between shares and stock is clearly explained, emphasizing the differences in ownership and representation of value.

Absolutely, Jason31. This article provides a lucid explanation of the concepts, making it easier for investors to make informed decisions.

This is a really informative post. I appreciate the detailed explanation of the differences between stocks and shares.

Absolutely, Fred. This is essential knowledge for anyone looking to invest in the stock market.

I totally agree, Fred. It’s important for investors to have a clear understanding of these concepts.

The nuances of stock issuance and the impact on the company’s register of members are well articulated in this post, offering a comprehensive understanding of the process.

I couldn’t agree more, Wendy62. The clarity provided in this article is invaluable for anyone keen to delve into stock investments.

The detailed explanation of the conversion of shares into stock is enlightening, providing a clear understanding of the transition process.

Absolutely, Dan Saunders. It’s crucial to comprehend the procedural aspects of stock issuance and conversion.

The distinction between preference shares and equity shares is well-defined in this article, shedding light on the different types of stock ownership.

Absolutely, Tony93. It’s important to be aware of the different rights and privileges associated with each type of stock.

I agree, Tony93. Understanding the various types of stock is crucial for informed investment decisions.

The detailed explanation of the process for converting shares into stock provides valuable insights into the corporate procedures involved in stock issuance.

That’s a great point, Sstewart. It’s not just about the ownership but also the administrative aspects of stock issuance.

I completely agree, Sstewart. This article serves as a comprehensive guide for understanding the intricacies of stock and share ownership.

Great article! The explanation of shares and stock ownership is clear and insightful.

The comparison table is especially helpful in summarizing the key differences between stocks and shares.

I agree, Zwilkinson. It provides a quick reference for anyone seeking clarity on this topic.

The distinction between nominal value and paid-up value in stocks and shares is well-described, shedding light on their differences in terms of capitalization.

Indeed, Ava45. Understanding the capital structure of companies is fundamental to evaluating investment opportunities.

The article effectively clarifies the distinction between stocks and shares, providing a comprehensive overview of these important investment instruments.

I agree, Cfox. This article is a valuable resource for anyone looking to gain a deeper understanding of stocks and shares.

Absolutely, Cfox. The content is well-researched and clearly presented, making it accessible to all investors.