The yield and return of almost every company are calculated annually. This is a good way to determine whether the investments made throughout the year have been profitable or not.

However, each of them is calculated using a different metric. Apart from this, there are several other differences that need to be understood.

Key Takeaways

- Yield measures the income generated by an investment, such as dividends or interest, relative to its price. In contrast, return measures an investment’s overall gain or loss, including income and capital appreciation.

- Yield is expressed as a percentage and is calculated annually, while return can be expressed as a percentage or a monetary value and can be calculated over any period.

- Investors use yield to compare income-generating investments, while the return is used to evaluate the overall performance of an investment or portfolio.

Yield vs Return

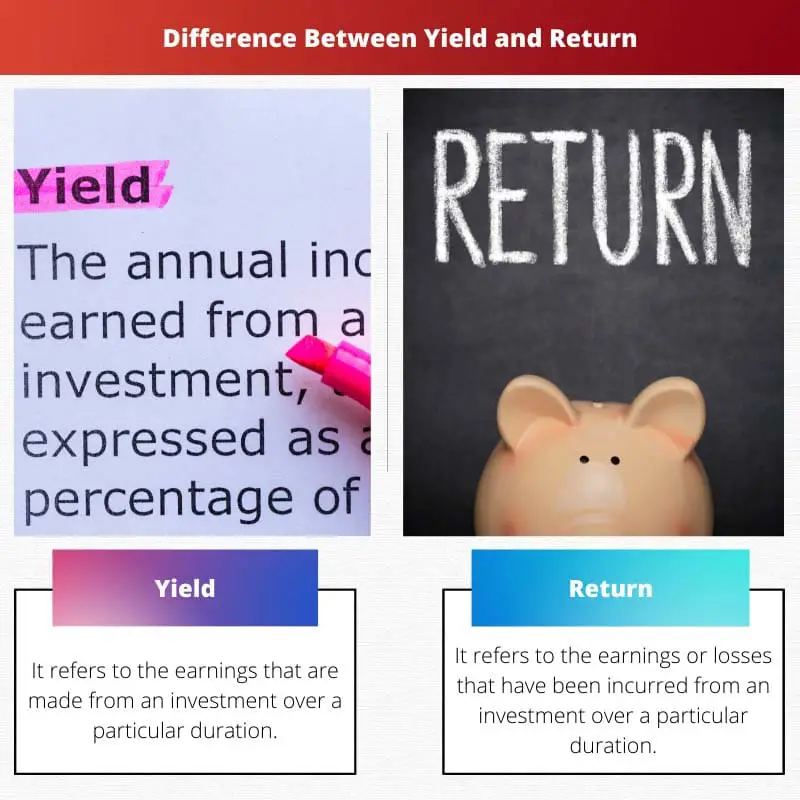

The difference between yield and return is that the term ‘yield’ is only used for earnings that are made from an investment over a particular duration and are expressed as a percentage, whereas the term ‘return’ is used for both earnings or losses that are incurred from an investment over a particular duration and is expressed as the difference in the holding’s value.

A yield is considered to be forward-looking as it is calculated before the actual earning comes in hand. The amount that has been yielded is either known or anticipated.

This is because the value of securities may fluctuate from time to time. Yield is calculated and expressed using the yearly percentage rate, face value, as well as current market value.

Meanwhile, a return is considered to be backwards-looking or retrospective as it revolves around the amount that has already been accrued.

Unlike yield, returns from an investment may be positive or negative. It is calculated by keeping in mind the interests, dividends, and capital gains (for example, when a share price increases).

Comparison Table

| Parameters of Comparison | Yield | Return |

|---|---|---|

| Meaning | It refers to the earnings that are made from an investment over a particular duration. | It refers to the earnings or losses that have been incurred from an investment over a particular duration. |

| Nature | It is forward-looking. | It is backwards-looking. |

| Connotation | It is either known or anticipated. | It is always known. |

| Expressed As | It is expressed as a percentage. | It is expressed as the overall change in value. |

| Basis | It is primarily based on yearly percentage rate, face value, and current market value. | It is primarily based on interests, dividends, and capital gains. |

| Risk | Yields take risks as one of the most important factors as they calculate anticipated future performance. | Returns do not represent a risk as they only measure past performance. |

What is Yield?

Yield refers to the earning or gains that a person has made over time by investing in securities. It is essentially an estimate of how much a person is going to make from an investment in the future.

The amount may be known or just anticipated. For this reason, yields are always considered to be forward-looking.

The way to express yield is through percentages. This is calculated based on the amount invested, the face value, and the present market value. When the yield is known, there is no need to take fluctuations into account.

Whereas when the yield is only anticipated, fluctuations play a major role in the calculation.

Yields are only future projections. Many risks can come into play in the future without a person knowing about them. For this reason, risks are considered while calculating an investment’s yield.

The greater amount of risk involved, the greater the amount of yield that is expected.

When it comes to stocks, there are two types of yields that are most commonly used. These include – the yield on cost and the yield of bonds. Each of them is calculated using a different method.

However, they both calculate the amount of earnings that have been gained by investment in stock.

What is Return?

Unlike yield, return expresses the earnings or losses that have been incurred over a particular duration when a person makes an investment. It is a way to calculate whether the company has made a profit or incurred a loss in the past.

For this reason, returns are always backwards-looking or retrospective.

The way to express returns is through a change in the overall value of the holding. This is calculated based on interests, dividends, and even capital gains.

They may be either be presented as net results or gross results. However, the return is always known as the amount that has already been acquired or lost.

Returns are not future projections. In fact, they are calculated based on how much a company has made in the past. For this reason, it is not necessary to include risk as a factor.

Even though all investments carry some risk with them, they have already come into play and affected the amount of earnings in the case of calculating returns.

There are three different ways in which returns can be calculated. These include – return on investment, return on assets, and return on equity. Each of them uses a different method for calculation.

Main Differences Between Yield and Return

- Yield refers to the earnings that are made from an investment over a particular duration, whereas return refers to the earnings or losses that have been incurred from an investment over a particular duration.

- Yield is forward-looking, whereas return is backwards-looking.

- Yield is either known or anticipated, whereas return is always known.

- Yield is expressed as a percentage, whereas return is expressed as the overall change in value.

- Yield is primarily based on yearly percentage rate, face value, and current market value, whereas return is primarily based on interests, dividends, and capital gains.

- Yields take risks as one of the most important factors as they calculate anticipated future performance, whereas returns do not represent a risk as they only measure past performance.

The post is quite detailed, but I still think understanding these concepts is a bit complex.

I found the explanation about risks and calculations of anticipated future performance in yield very insightful. Great post!

I appreciate the detailed examples provided for yield and return. Kudos to the writer.

Thank you for including the comparison table. It really helped me understand the differences between yield and return.

You are welcome, Young Eden. I sure hope the comparison table was of assistance.

I never really bothered to understand the difference between yield and return until now. This was very informative and easy to read.

I agree, it was quite simple to comprehend.

I was thinking the same thing, the difference between them is much clearer now. Thanks for sharing.

The explanation of yield and return was very clear, and the comparison table summed up the differences nicely.