Generally, a year denotes 12 months, with about 365 days and 366 days if it is a leap year. We hear about the terms of the fiscal year and calendar year, but many of us don’t even know what it represents and the differences between them.

Both years have 365 days, but the starting and ending periods differ.

Key Takeaways

- A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard January 1 to December 31 period.

- Governments and organizations can choose fiscal years to align with their budgeting and tax requirements.

- Financial reporting and taxation are based on fiscal years, while calendar years are primarily used for general planning and scheduling.

Fiscal Year vs. Calendar Year

A calendar year is a 12-month period of time used for various purposes, such as taxation, financial reporting, and legal documentation. A fiscal year is a 12-month period that a company or organization uses for financial reporting and budgeting purposes. It starts on the first day of a quarter, such as April 1 or October 1.

A fiscal year where we can choose any starting and ending date, but it should have 365 days in total. The business uses the fiscal year. Generally, it helps to record the respective company’s profits, losses, taxation, etc.

On the other hand, the general year, where we count the start from 1st January to the end of 31st December, is known to be a Calendar Year. Generally, all the holidays are based on the Calendar Year.

Comparison Table

| Parameters Of Comparison | Fiscal Year | Calendar Year |

|---|---|---|

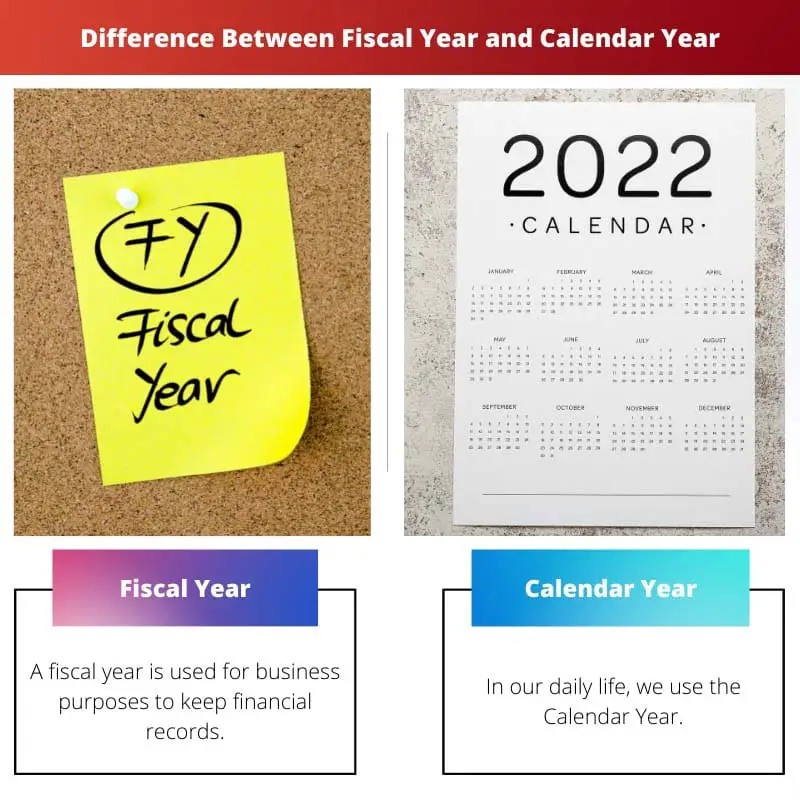

| Usage | A fiscal year is used for business purposes to keep financial records. | In our daily life, we use the Calendar Year. |

| Tax Reporting | It is comparatively complicated for tax reporting during a fiscal year. | In a calendar year, it is easy and simple for tax reporting. |

| Income and Expense History | A fiscal year holds income and expense history together. | Income and expenses are divided into two individual parts in a Calendar year. |

| Relations Between Two Companies | When two companies have different fiscal years, it becomes difficult to any comparison between them. | There is exactly 12 months time period for Calendar Year. |

| Period | Generally, the fiscal year does not have an accurate starting and ending period. | There are exactly 12 months time period for Calendar Year. |

What is a Fiscal Year?

A year, in general, presents 12 months, and a fiscal year is also a year where there are about 12 months and a total of 365 days, but a fiscal year is a term that is used by the people who are associated with business enterprises or government franchises as well.

A fiscal year is a period used for keeping records of the financing accounts for various organizations. When a period is accounted as a fiscal year, it becomes easy and simple to keep records, especially for the financial section.

A fiscal year can start from any calendar date or month. The only obligation is that it should consist of 365 days, not more or less than that.

A fiscal year makes the tax reporting process complex, so people do not consider it. One major benefit of the fiscal year is that it accounts for the income and expense history.

The fiscal year helps people in several ways, such as it avoids tax burdens, it also helps to choose any date or month for profits, etc.

A few examples of usage of a fiscal year are- India’s fiscal year accounts from 1st April to 31st December and the fiscal year for U.S federal- from 1st October to 31 September.

What is a Calendar Year?

The Calendar year is the period that starts from 1st January and ends on 31st December yearly. The yearbook that we follow in general is called a Calendar Year. A calendar year consists of 365 days or 366 days (When it is a leap year).

And we are bound to follow the calendar year from 1st January to 31st January, and hence we can not change it as it is followed by everyone worldwide. We can not decide the Calender year on our own as it is internationally recognized.

It has been noticed that a calendar year makes tax reporting easy and simple to follow. Also, the holidays, birthdays, anniversaries, and death anniversaries are accounted for as per the Calendar year.

It helps in such tasks and is associated with other benefits like its easy-to-follow, widespread usage, etc. And during a calendar year, the income and expenses are separated and then calculated.

The calendar year also helps to calculate or compare two companies’ finances. This is because the differences are easy and clear during a calendar year, even though they might have variant fiscal years.

Main Differences Between Fiscal Year and Calendar Year

- Business enterprises mainly use the fiscal year; on the other hand, the main yearly record used daily is the calendar year.

- The tax reporting services become a bit complicated in a fiscal year, while on the other hand, the calendar year helps to keep the tax reporting easy.

- The income and expense are combined in a fiscal year, while on the other hand, the calendar year separates the income and expense history.

- It isn’t easy to differentiate between two companies in terms of their respective fiscal year, while on the other hand, the calendar year enables us to compare two companies.

- A fiscal can be started from any date of the year, while on the other hand, there is an accurate date selected for the calendar year to start.

- https://academic.oup.com/qje/article-abstract/113/1/149/1891996

- https://books.google.com/books?hl=en&lr=&id=SA9JbrjZ2NkC&oi=fnd&pg=PP8&dq=fiscal+year+vs+calendar+year&ots=1uYy4FGOr2&sig=JW69LmoUykCtpsFDD6FIy8zux1w

Positive comment on fiscal year’s importance

Great post for understanding fiscal years!

Liked the detailed explanation of fiscal year and calendar year

Negative perspective about fiscal year terms

Didn’t find the article interesting

Ironically explains the differences between fiscal year and calendar year

Sarcastic comment on the general year

The general year is what saves us from the chaos

Argumentative comment on fiscal year

Informative comment about fiscal year

Good explanation for fiscal year terms

Clarity of thoughts presented here are commendable