Gross Profit is the revenue remaining after deducting the cost of goods sold (COGS) from total sales, representing the basic profitability of core business operations. Net Profit, on the other hand, is the final amount after subtracting all expenses, including operating costs, interest, and taxes, providing a comprehensive measure of overall profitability.

Key Takeaways

- Gross profit is the revenue that remains after deducting the cost of goods sold, while net profit is the amount of income that remains after deducting all expenses.

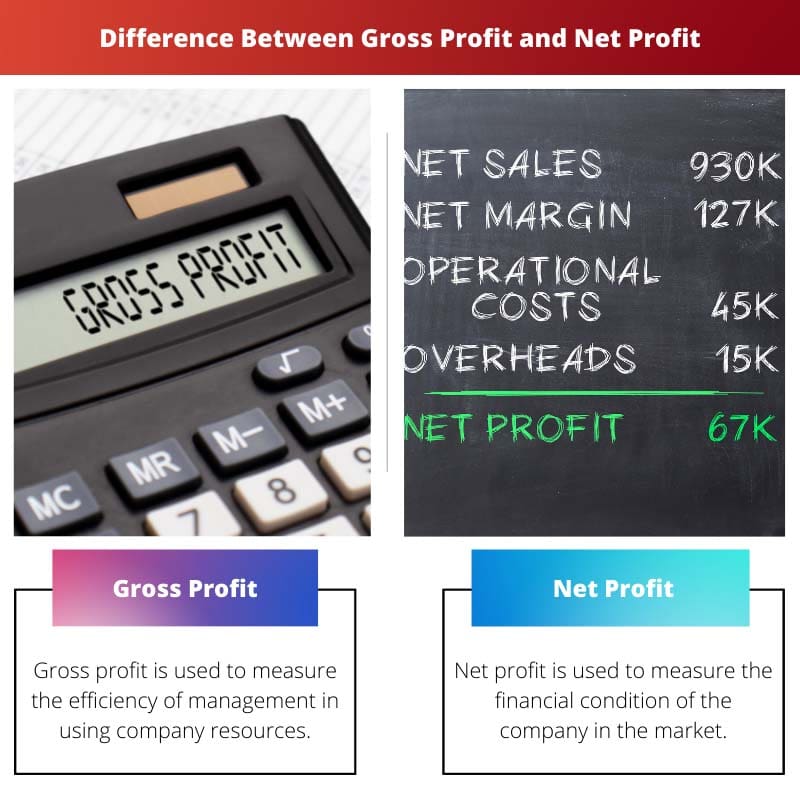

- Gross profit is used to determine the profitability of a company’s core business activities, while net profit reflects the overall profitability of a company, including all expenses.

- Gross profit is calculated before operating expenses, such as rent and salaries, while net profit is calculated after all operating costs and taxes are deducted.

Gross Profit vs Net Profit

The difference between gross and net profit is that gross profit is invaded by subtracting the total cost of goods sold from the total yield. On the other hand, net profit is obtained by subtracting the indirect and direct expenses from the total yield. Gross profit gives rough profits, but net profit gives real profits.

The gross profit is the expected profit that may or may not be achieved after all product sales. The gross profit only includes the direct expenses incurred for producing the goods and services.

The net profit is the actual profit earned by the company in a particular accounting period. It is invaded by deducting all the indirect expenses from the gross profit or both direct and indirect costs from the total revenue.

Comparison Table

| Feature | Gross Profit | Net Profit |

|---|---|---|

| Calculation | Revenue from Sales – Cost of Goods Sold (COGS) | Gross Profit – Operating Expenses – Other Income/Expenses |

| Focus | Profitability of core operations (production/sales efficiency) | Overall profitability of the business |

| Components Considered | Only manufacturing costs directly related to producing goods sold | All business expenses including operating expenses, taxes, and interest |

| Significance | Shows how efficient a business is at converting COGS into profit | Represents the company’s bottom line – the ultimate profit after all expenses |

| Location in Financial Statements | Income Statement (part of the calculation for Net Profit) | Income Statement (the final profit figure) |

What is Gross Profit?

Gross profit is a key financial metric that represents the difference between a company’s revenue and its cost of goods sold (COGS). It serves as a fundamental measure of a company’s profitability before accounting for other operating expenses. The gross profit formula is simple:

Gross Profit=Revenue−Cost of Goods Sold (COGS)

Components of Gross Profit

- Revenue:

- Gross profit starts with the total revenue generated by a business. This includes all sales of goods and services during a specific period.

- Cost of Goods Sold (COGS):

- COGS encompasses all direct costs associated with producing or purchasing the goods that a company sells. This includes the cost of raw materials, labor, and manufacturing overhead.

Importance of Gross Profit

- Profitability Indicator:

- Gross profit provides insight into a company’s ability to generate profit from its core business activities. A higher gross profit margin indicates efficient production and pricing strategies.

- Financial Health:

- Investors and analysts often use gross profit as an initial assessment of a company’s financial health. It helps determine if a business can cover its variable costs and contribute to fixed costs.

Gross Profit Margin

The gross profit margin is a related metric expressed as a percentage, calculated by dividing gross profit by revenue and multiplying by 100:

Gross Profit Margin (%)=(Gross Profit/Revenue)×100

Analysis and Interpretation

- High Gross Profit Margin:

- A high margin indicates that a company effectively controls its production costs relative to its revenue, suggesting strong profitability.

- Low Gross Profit Margin:

- Conversely, a low margin may indicate challenges in cost management, pricing, or competition, which could impact overall profitability.

Limitations

- Exclusion of Operating Expenses:

- Gross profit does not account for operating expenses such as marketing, administration, and research and development. It provides a limited view of overall profitability.

- Industry Variations:

- Different industries may have varying average gross profit margins, making it essential to consider industry benchmarks when assessing a company’s performance.

What is Net Profit?

Net Profit, also known as Net Income or Bottom Line, is a key financial metric that reflects the profitability of a business after deducting all expenses from its total revenue. It serves as a crucial indicator of a company’s financial health and success.

Formula:

Net Profit=Total Revenue−Total Expenses

Components of Net Profit

1. Total Revenue

Total Revenue encompasses all the money generated by a business through its primary operations, including sales of goods or services. It is the starting point in calculating Net Profit.

2. Total Expenses

Total Expenses represent the sum of all costs incurred by a company during its normal course of business. This includes operating expenses, interest, taxes, and other miscellaneous costs.

Importance of Net Profit

1. Profitability Assessment

Net Profit is a fundamental metric for evaluating the overall profitability of a business. A positive Net Profit indicates that the company is generating more revenue than it spends, signaling financial success.

2. Performance Benchmarking

Comparing Net Profit over different periods allows businesses to assess their financial performance and identify trends. It aids in setting benchmarks and goals for future growth.

Factors Influencing Net Profit

1. Operating Efficiency

Efficient management of day-to-day operations can positively impact Net Profit. Streamlining processes and reducing wasteful expenditures contribute to higher profitability.

2. Pricing Strategies

A company’s pricing strategy directly affects its revenue, and consequently, its Net Profit. Finding the right balance between competitive pricing and profit margins is essential.

3. Cost Control

Effective cost control measures are critical to maximizing Net Profit. Managing expenses, negotiating favorable supplier contracts, and minimizing waste contribute to improved profitability.

Limitations of Net Profit

1. Exclusion of Non-Operating Items

Net Profit may not fully reflect a company’s financial health as it excludes certain one-time gains or losses, impairments, and non-operating items.

2. Tax Impact

Net Profit is influenced by the tax rate applicable to the business. Changes in tax regulations can impact a company’s bottom line.

Main Differences Between Gross Profit and Net Profit

- Definition:

- Gross Profit is the total revenue minus the cost of goods sold (COGS).

- Net Profit is the total revenue minus all expenses, including COGS, operating expenses, interest, and taxes.

- Calculation:

- Gross Profit = Revenue – Cost of Goods Sold (COGS)

- Net Profit = Gross Profit – Operating Expenses – Interest – Taxes

- Scope:

- Gross Profit focuses solely on the direct costs associated with producing goods or services.

- Net Profit takes into account all expenses incurred in running the business, providing a more comprehensive view of overall profitability.

- Interpretation:

- Gross Profit indicates the efficiency of production and the ability to control production costs.

- Net Profit reflects the overall financial health of the business after considering all costs and expenses.

- Components:

- Gross Profit includes only the direct costs related to the production process.

- Net Profit includes both direct costs and indirect costs such as operating expenses, interest, and taxes.

- Margins:

- Gross Profit Margin is the percentage of revenue that exceeds the cost of goods sold and is a measure of production efficiency.

- Net Profit Margin is the percentage of revenue that remains as profit after deducting all expenses, providing a broader view of overall profitability.

- Usefulness:

- Gross Profit helps assess the efficiency of production and pricing strategies.

- Net Profit is a key indicator of the business’s overall profitability and sustainability.

- Relation:

- Gross Profit is a component of the calculation for Net Profit.

- Net Profit is derived from subtracting all expenses, including COGS, from the total revenue.

- https://www.google.co.in/books/edition/A_Text_Book_of_I_S_C_Economics_Vol_II/ubjiXNPH3cUC?hl=en&gbpv=1&dq=books+on+gross+and+net+profit+theory&pg=PA244&printsec=frontcover

- https://link.springer.com/content/pdf/10.1007/0-387-29903-3_1.pdf

The detailed comparison table is very helpful in understanding the differences between gross profit and net profit.

I completely agree. It’s a great visual aid for grasping the key points.

I thoroughly enjoyed reading this article. The clarity and depth of explanation are commendable.

I couldn’t agree more. It’s a well-crafted piece that serves as an excellent educational tool.

The article provides a solid foundation for understanding gross and net profit, making it an invaluable resource.

The article provides a comprehensive explanation on the topic of gross and net profit. This information is very useful for business owners and investors.

I found the section on profitability analysis particularly insightful.

Absolutely, understanding these concepts is crucial for making sound business decisions.

This is such an important aspect of business finance. The explanations are quite clear and I learned a lot from reading this article.

I feel the same way. It’s definitely a must-read for business students.

This article simplifies a complex topic and makes it easy to understand. Great job!

Thank you for sharing this informative article. The comparison table adds clarity to the concepts discussed.

The breakdown of the formulas for gross profit and net profit was very useful.

I appreciate the detailed explanations. It’s evident that a lot of thought went into this article.

The explanations of gross and net profit are detailed and well-organized. I appreciate the depth of information.

I believe this article is a valuable resource for anyone looking to delve into the financial aspects of business operations.

The references provided at the end of the article add credibility to the information presented. Very well-researched.

Absolutely, having reliable sources increases the confidence in the accuracy of the content.

I really enjoyed reading this article and I think it does a very good job at explaining the differences between gross and net profit. It’s very useful.

I agree, the article is very informative and gives a lot of good examples.

This information will be very helpful for anyone trying to understand the financials of a business.

I found the sections on the objective and inclusion of gross and net profit in the income statement to be quite illuminating.

Agreed. The article covers the topic from multiple angles, which is very beneficial.

The article effectively captures the essence of gross and net profit, making it understandable to a wide audience.

The language used is accessible, and the examples provided are relatable, which enhances the learning experience.