What is life if you don’t live it and enjoy it to the fullest?

Planning your journey is a huge step towards yourself and your future, and here you’ll learn the difference between lease and buy, which is the most crucial financial aspect of adulthood that every individual must deal with in the long run.

Key Takeaways

- Leasing involves paying for the use of a vehicle over a specific period while buying entails purchasing the vehicle outright or through financing.

- Leasing has lower monthly payments but requires returning the vehicle at the end of the term.

- Buying a vehicle allows for customization, no mileage restrictions, and long-term ownership.

Lease Vs Buy

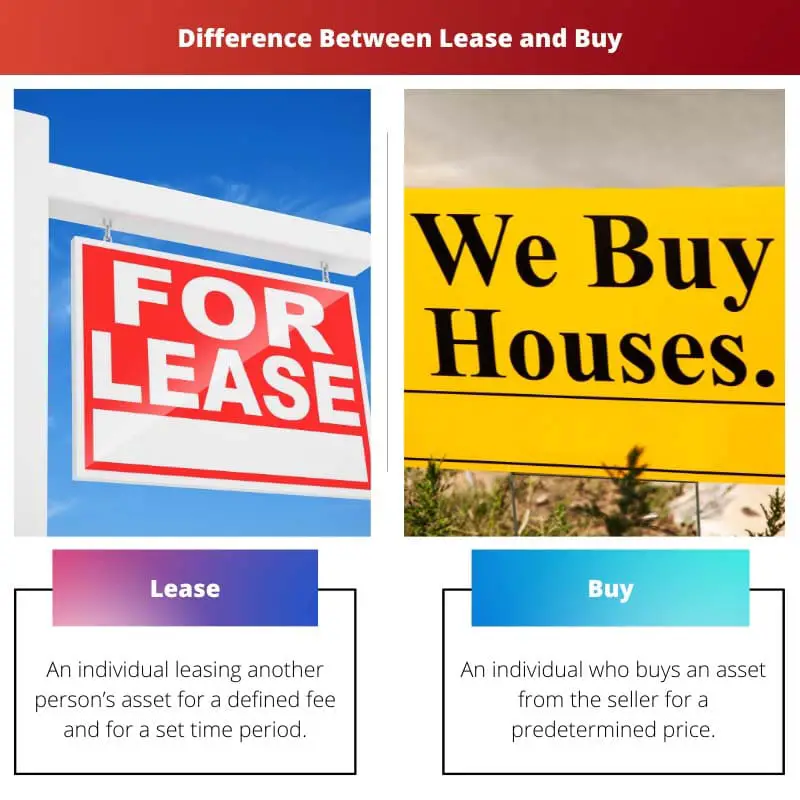

Leasing is a contractual agreement between two parties where the owner of an asset (the lessor) allows another party (the lessee) to use the asset for a specified period of time. Buying involves purchasing an asset outright, using cash or financing. Once the asset is purchased, the buyer becomes the owner.

A lease occurs when a person purchases an asset and then rents or grants it to another individual for a defined length of time.

It comprises the long-term rental of an asset to another person for a predetermined amount of money to be paid at predetermined intervals by the asset’s owner.

Buying is the process of obtaining full ownership of an object from a prior buyer in exchange for a pre-determined amount of money.

As the ownership of an asset or title transfers to a new owner, the risks and benefits associated with the asset pass along with it as the rights and possession belong to the new owner.

Comparison Table

| Parameters of Comparison | Lease | Buy |

|---|---|---|

| Meaning | An individual leasing another person’s asset for a defined fee and for a set time period. | An individual who buys an asset from the seller for a predetermined price. |

| Ownership | The ownership of an asset belong to the owner who rented it out via a lease agreement. | After all the agreements are completed, the asset’s ownership is solely in the hands of the buyer. |

| Cost | The cost of leasing assets is substantially lower than the cost of buying them. | Buying an item is significantly more expensive than using or leasing it. |

| Time Period | The person who leases the item has signed a contract for a fixed period of time. | For an indefinite period of time, the asset belongs to the person who buys it. |

| People Involved | A lessee refers to the individual who leases the asset, and a lessor refers to the person who owns the asset. | The buyer who buys the asset and the seller who sells the asset to the buyer. |

What Is Lease?

A person leases a home when they relocate to a new city or want to embark on a new adventure and require a place to live for a set period of time.

A lease is a contract in which a person offers another person the right to use their asset in exchange for a predetermined payment.

The lessor (the asset’s owner) and the lessee (the asset’s leaser) are responsible for the contract formed for the lease or rent of an asset. The asset is rented to an individual for a long period of time by the owner.

Finance leases and operating leases are the two types of leases that are evaluated during the contracting process.

Finance leasing is when the owner retains ownership rights while the risks and benefits are transferred to the person who leases the asset, and ownership of the item can be transferred to the lessee for a modest fee at the end of the contract.

Operating leases are when the risks and rewards of ownership are not transferred to the person renting the asset, and the asset is returned to the owner at the end of the contract.

The lessee pays the agreed price for the asset at predetermined intervals, which is termed the lessor’s earning on the asset. People lease assets because it is less expensive than buying them outright.

Some businesses do this because leasing an asset is more cost-effective for them to expand in the beginning.

What Is Buy?

Families that are beginning a family or looking for a new place to create memories buy a home.

Buying is a procedure in which a buyer acquires full possession and ownership of an asset from someone who is selling it for a specified price, and the risks and rewards are instantly passed to the buyer with the title.

The agreed-upon money to be paid to the seller by the buyer can be paid in full in one go or pledged to be paid in monthly instalments after a down payment is made.

The total price, or down payment, taxation, processing fee, and other expenses make up the upfront cost.

Finally, once the buyer has completed all of the formalities and has full ownership of the item, they are free to use, sell, or transfer the asset however they see fit.

In addition, the new owner is responsible for any necessary alterations, repairs, or maintenance.

Buying is also seen as a once-in-a-lifetime investment, as well as a costly one. When buying something, a large sum of money is required, which is paid in instalments.

In big companies’ financial accounts, the purchased asset can be listed on the assets side of the balance sheet, and the asset’s value can be expensed during its useful life, with the amortisation value being reported as a cost in the financial statement.

Main Differences Between Lease and Buy

- A lease is when a person rents or leases an asset from another person for a certain amount of time and money, whereas buying is when a person purchases the ownership of an asset from its seller for a set amount of money.

- In a lease, the asset’s ownership and possession belong to the person who rented it through an agreement, however when a person buys an item from a seller, the asset’s whole possession and ownership belong to the new owner.

- The cost of leasing an asset is significantly lower than the cost of buying it, whereas the cost of buying an asset is extremely high.

- A person who leases an asset from its owner has it for the duration of the signed contract, but a person who buys it has it for an indeterminate amount of time.

- A lessee (who leases the asset) and a lessor (who owns the asset) are involved in a lease, whereas a buyer and a seller are involved in a buying.

A thorough and informative overview of lease versus buy which is so important for anyone needing to make a significant purchase like a car. Great job!

I completely agree – a very helpful and educational article.

This is not the most important aspect of adulthood. There are so many other things that are more crucial.

The article could have been a bit more concise, but overall the content is well presented and of high quality.

The author is obviously highly knowledgeable about the subject. The article is very well written and persuasive.

I find it rather amusing that this article focuses on car leasing as the most critical financial aspect of adulthood.

The comparison table is really helpful, but the article could be more engaging if it were supplemented with real-life examples.

I disagree, the as is provides a lot of useful information and doesn’t need real-life examples.