The system of taxes is practised in almost every country in the world. The most common reason is to generate revenues for government expenditures.

Taxes may be levied on the federal level, local and state levels. It is essential to understand the difference between various types of taxes to understand our country’s infrastructure.

Key Takeaways

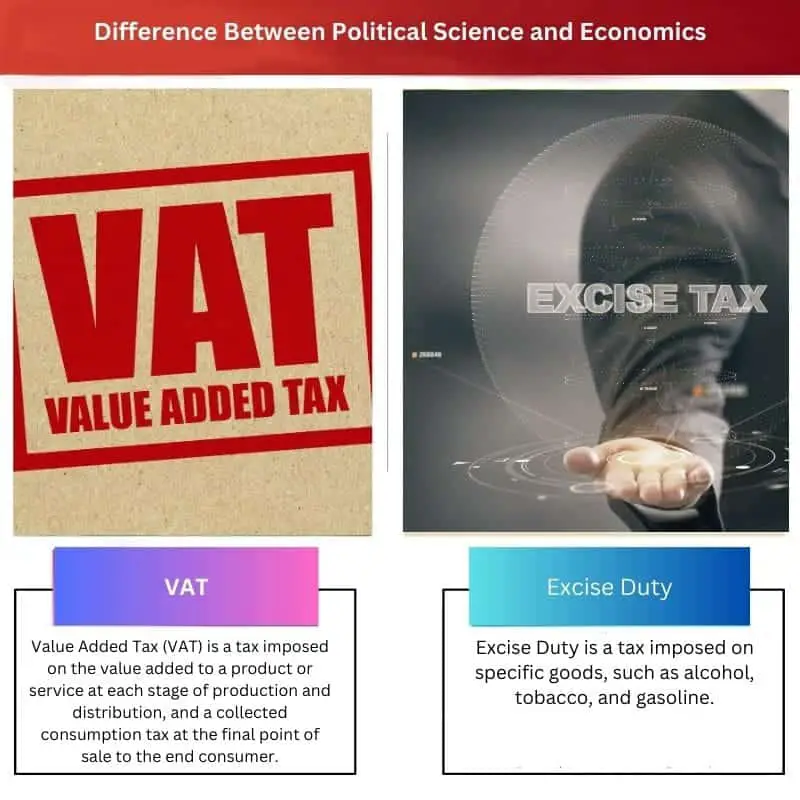

- VAT is a tax on the value added at each production stage, while excise duty is a tax on specific goods or services, at production or importation.

- VAT is charged as a percentage of the final price of a product or service, while excise duty is charged as a fixed amount per unit of the goods or services.

- VAT is a more general tax that applies to a wide range of goods and services, while excise duty is applied to specific products like alcohol, tobacco, and fuel.

VAT vs Excise Duty

Value Added Tax (VAT) is a tax imposed on the value added to a product or service at each stage of production and distribution, and a collected consumption tax at the final point of sale to the end consumer. Excise Duty is a tax imposed on specific goods, such as alcohol, tobacco, and gasoline.

Excise duty is the tax added to the manufacturing of goods. It is imposed at the time of manufacturing and not at the time of sale, unlike VAT. Their difference is best understood by this example here.

When the company is making soap, then after it is made, it has to pay excise duty even before selling the soap. The comparison table below shows the other features that differentiate between VAT and excise duty.

Comparison Table

| Parameter of Comparison | VAT | Excise Duty |

|---|---|---|

| Definition | Tax is added on goods as it travels from the point of production to the end of the sale. | Tax added on the manufacturing of stocks. |

| Imposed | After the product has entered the final stage of selling. | After the product has been manufactured. |

| Paid by | Customers who buy the product. | The company that is manufacturing the product. |

| Implementation | Method of collection and timing of collection. | Ad valorem and specific. |

| Examples | Biscuits, candy, soap, toothpaste, shoes. | Tobacco, alcohol, fuel. |

What is VAT?

VAT stands for value-added tax. It is the amount of cost added to the product after it has reached the final stage of trading. The VAT system is exercised in over 160 countries around the world.

The customer only needs to pay VAT for the end product, not the raw materials required to manufacture the product.

The state decides the tax rate as a percentage of the end product. It is implemented in two ways:

- Method of collection

- Timing of collection

In the collection method, the seller sends the buyer an invoice with the amount of tax in it. The other way is that no specific invoice is generated and calculated based on the value added to the product.

What is Excise Duty?

Excise duty is the amount of tax added at the time of manufacturing of the goods. Customers may not see this amount directly as the company needs to pay them to the excise departments according to the government’s infrastructure.

As a result, the manufacturers increase the price of the end products to accommodate that cost. It is a business tax that the companies need to pay apart from other taxes like income tax.

It is implemented in one of two ways:

- Ad valorem

- Specific

In ad valorem, there is a fixed percentage of certain types of goods. The specific amount is applied to purchases with high social costs, like airline tickets, cigarettes and alcohol.

Main Differences Between VAT and Excise Duty

Some of the features that differentiate between VAT and excise duty are given below:

- VAT implementation is carried out by the method of collection and the timing of collection. The ad valorem method and the specific method carry out exercise duty implementation.

- VAT goods include biscuits, candy, soap and toothpaste, and shoes, while excise duty goods include tobacco, alcohol, airline tickets and motor fuel.

- https://pdfs.semanticscholar.org/f474/c44a44902007cca8fe0759b81ba2a5ab44e7.pdf

- https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1468-5965.1988.tb00335.x

Last Updated : 13 July, 2023

Emma Smith holds an MA degree in English from Irvine Valley College. She has been a Journalist since 2002, writing articles on the English language, Sports, and Law. Read more about me on her bio page.

An extensive evaluation of VAT and Excise Duty is presented in the article, suitable for individuals seeking an in-depth comprehension of tax systems.

The article provides an excellent in-depth analysis of the VAT and Excise Duty tax systems, providing a clear understanding of the key takeaways.

I couldn’t agree more, Griffiths. The comparison table for VAT and Excise Duty is particularly informative.

The article’s detailed contrast between VAT and Excise Duty serves as an insightful guide for understanding tax structures, making it advantageous for readers.

I completely agree, Nthomas. The article’s comprehensive coverage fosters a deeper understanding of these essential taxation matters.

The article fails to address the practical implications of these taxation systems, which are equally significant for understanding their impact.

You make a valid point, Ruby. While the theoretical aspects are covered well, insights into practical applications would further enhance the content.

I find the article to be overly biased towards VAT, downplaying the importance and impact of Excise Duty.

I share the same sentiment, Rachel. A more balanced view of both tax systems could improve the overall credibility of the content.

The lack of objectivity is indeed apparent, Rachel. A balanced approach would lend more authority to the analysis.

The article provides a comprehensive understanding of the taxation principles and their differences, serving as an excellent educational resource.

Absolutely, Yjames. The detailed explanations of VAT and Excise Duty facilitate a clear comprehension of these tax systems.

The article’s detailed exploration of VAT and Excise Duty augments readers’ comprehension of complex taxation systems, offering a significant educational value.

I share your viewpoint, Scott. The analytical depth of the article enhances clarity in comprehending these intricate tax structures.

Well-said, Scott. The educational merit of the content is indeed commendable, providing valuable insights into VAT and Excise Duty.

The article illuminates the distinctions between VAT and Excise Duty with meticulous detail, allowing readers to grasp complex tax concepts effectively.

Well-stated, Richardson. The intellectual depth of the content distinguishes it as an exceptional informational material on taxation.

I couldn’t agree more, Richardson. The clarity of explanations makes it easier for readers to understand these tax systems.

The article delivers an intellectual discourse on VAT and Excise Duty, providing an enriching learning experience for readers.

Absolutely, Frank. The insightful nature of the content contributes to a more profound understanding of taxation dimensions.

The article effectively conveys the details of VAT and Excise Duty, essential for anyone to understand the country’s taxation infrastructure.

Absolutely, White. These concepts are crucial for anyone to gain a comprehensive understanding of taxation systems.

Indeed, it’s a well-structured and informative piece. Kudos to the author for this detailed explanation.