Operating income and Earnings Before Interest and Taxes are terms used in accounting and business accounting to describe a company’s or business’s revenue. These two accounting phrases influence a company’s or firm’s success.

In most cases, individuals misunderstand EBIT and operating profit and think they are the same thing. The EBIT method is used to determine the most valuable organization or company based on its operational efficiency.

The operating profit tool assists a businessperson in maximizing all available resources.

Key Takeaways

- EBIT (Earnings Before Interest and Taxes) is a financial metric representing a company’s profitability before accounting for interest expenses and income taxes. At the same time, operating profit is a metric that represents a company’s profitability after accounting for all operating expenses.

- EBIT is used to compare the performance of companies without the influence of their financing decisions while operating profit is used to evaluate a company’s operational efficiency.

- EBIT is used in financial analysis to calculate a company’s valuation and potential for growth. In contrast, operating profit assesses its ability to generate profit from its core business activities.

EBIT vs Operating Profit

EBIT is calculated by subtracting all operating expenses from revenue, excluding interest and taxes. Operating profit is calculated by subtracting all of a company’s operating expenses from its revenue before considering interest payments, taxes, or other non-operational income or expenses.

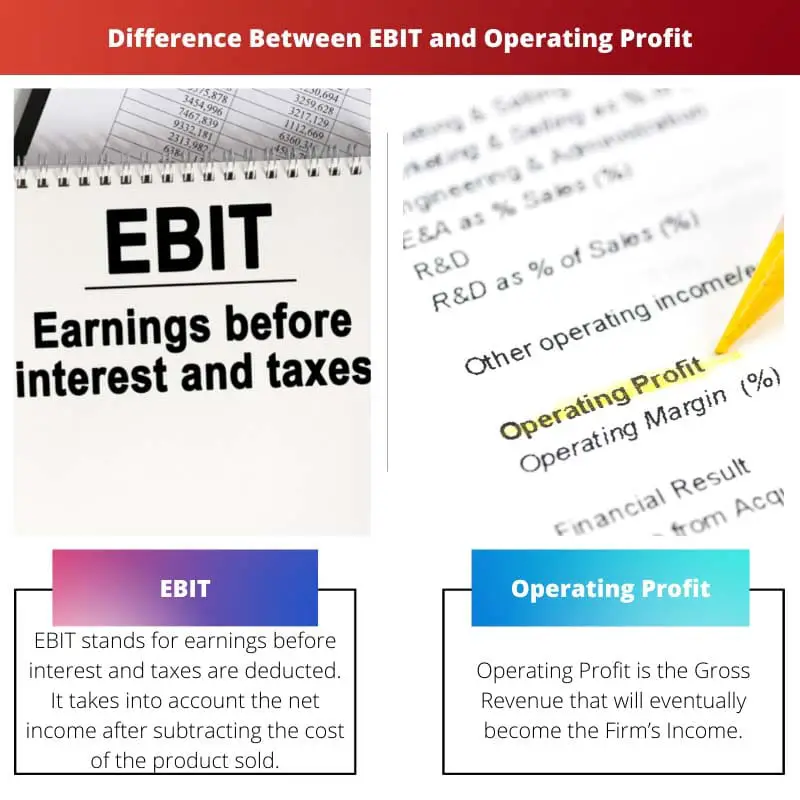

EBIT stands for earnings before interest and taxes are deducted. It takes into account the net income after subtracting the cost of the product sold.

After subtracting operating expenses and depreciation, add interest and tax expenses. You get the profit when you add interest and taxes to your net income. Non-operating revenue and costs are also included.

Operating Profit is the Gross Revenue that will eventually become the Firm’s Income. We calculate our operating income by reducing the cost of goods sold and operating expenses from total sales.

To configure operational income, we need to know what is included in operating expenditures, what is omitted, and what is included within the Cost of Goods Sold.

Comparison Table

| Parameters of Comparison | EBIT | Operating Profit |

|---|---|---|

| Definition | EBIT is a measure of a company’s profitability before income tax and interest deductions are taken into account. | The overall earnings from a company’s main business activities, less interest, and taxes, are known as operating profit. |

| Calculated on | Net Income | Gross Income |

| GAAP rules | EBIT doesn’t work under GAAP rules | Operating Profit works under GAAP rules |

| Adjustments In Calculations | Yes | No |

| Usage for Investors | Investors use EBIT to determine a company’s operational efficiency. | Investors use operating profit as an indirect indicator of profitability. |

What is EBIT?

Earnings before interest and taxes is a financial abbreviation. It is defined as a company’s entire revenue before interest and tax deductions.

Other phrases that are used to refer to EBIT include operational income, operational earnings, and so on. EBIT is a simple metric that measures a company’s capacity to generate profits from its activities.

When an investor considers acquiring a company or comparing it to its market competitors, EBIT is critical. It enables them to make accurate inferences about a company’s essential activities. Consequently, it is critical for investors.

Investors use EBIT to determine the most profitable companies. However, because interest savings and tax offsets are not included in its calculations, it is not a highly reliable method of measuring a company’s profitability.

It is a more accurate indicator of a company’s efficiency. Because each company’s or firm’s tax and finance arrangements are unique, the EBIT assists in evaluating profitability.

Investors use the EBIT method to track the most lucrative corporation or company in terms of operational efficiency. It is used by governments, stockholders, and unsecured creditors.

Interest and costs are not taken into account. The cost of doing business is overlooked. Operating costs are taken into account.

What is Operating Profit?

After subtracting operational costs from gross profit, operating profit refers to the profits that remain with the company or corporation.

When this technique of computation is utilized, the amount that may be used for any continuing activity, such as investing or paying taxes, can be determined.

For businessmen, operating profit is also a useful method. A businessman may utilize the operational profit tool to make the most of all available resources.

If the operational profit falls, it’s likely that something is changing in the firm, whether it’s in the operations or the market. When operating profit starts to fluctuate, it’s an indication that something has to change in the company.

The net income generated by a company’s principal or core business operations is known as operating profit.

Because interest and taxes are non-operating expenditures, active profit is also known as earnings before interest and tax. Non-operating income is not included in operating profit, although it is included in EBIT.

Operating profit removes several unnecessary and indirect elements that might hide a company’s true performance.

Because a firm’s net profit includes the impacts of interest charges and taxes, companies might opt to publish their operational profit statistics instead of their net profit data.

Main Differences Between EBIT and Operating Profit

- EBIT is a measure of a company’s profitability before income tax and interest deductions are taken into account, whereas The overall earnings from a company’s main business activities, less interest and taxes, are known as operating profit.

- EBIT is calculated on net income, whereas Operating Profit is calculated on Gross Income.

- EBIT doesn’t work on GAAP rules, whereas Operating Income works on GAAP rules.

- Adjustment in the calculation is made in EBIT, whereas there is no adjustment in the calculation in the case of Operating Profit.

- Investors use EBIT to determine a company’s operational efficiency, whereas Investors use operating profit as an indirect indicator of profitability.

The distinction between EBIT and operating profit is made clear by the article, and the examples provided help further illustrate their significance in financial analysis.

The article accurately presents the financial metrics of EBIT and operating profit, highlighting their different applications and the nuanced adjustments involved in their calculations.

The article elegantly explains the differences between EBIT and operating profit, providing readers with an understanding of their importance in the business world.

The article’s analysis of EBIT and operating profit serves as a valuable resource for those seeking to increase their knowledge of financial evaluation and company profitability.

The explanation of EBIT and operating profit in the article is comprehensive and demonstrates the attention to detail required in financial matters.

The article adeptly explores the application of EBIT and operating profit, enriching readers’ understanding of how these metrics can be employed to facilitate informed investment decisions.

Readers are provided with an insightful comparison of EBIT and operating profit, conveying the complexity and impact of these accounting methods on a company’s financial health.

The article’s comprehensive examination of EBIT and operating profit demonstrates the necessity of a deep understanding of these financial measures to accurately assess a company’s performance.