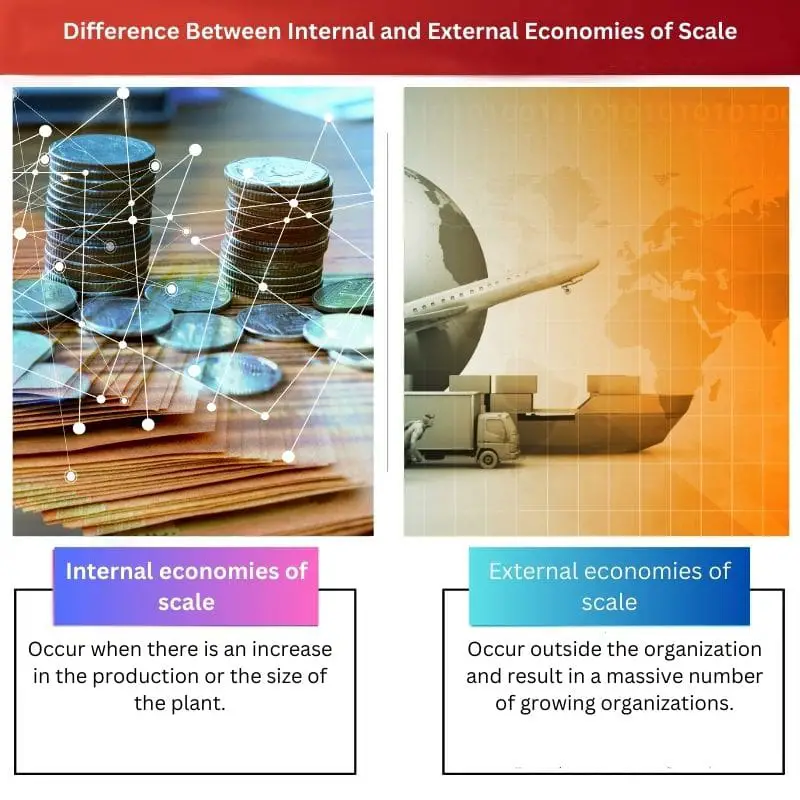

Internal economies of scale result from cost savings within a firm as it expands, such as increased specialization and efficient resource utilization. External economies of scale occur when multiple firms in the industry experience cost reductions due to overall industry growth, shared infrastructure, or improved transportation networks.

Key Takeaways

- Internal economies of scale arise from a company’s growth, leading to reduced average costs due to increased production, specialization, or technological advancements.

- External economies of scale occur outside a company, resulting from industry growth, regional specialization, or improved infrastructure.

- Both types contribute to improved efficiency and cost savings, but the company controls internal economies of scale, while external factors influence external economies of scale.

Internal vs External Economies of Scale

The difference between internal and external economies of scale is that internal economies of scale are the benefits of the growth of a specific firm they are associated with. In contrast, external economies of scale are the benefits that arise when numerous firms are in the industry.

Alfred Marshall, a well-known economist, was the first to discriminate between the two types of economies of scale a company could achieve and termed them internal and external economies of scale.

Contrarily, external economies of scale refer to the outside factors that affect the whole industry.

Comparison Table

| Feature | Internal Economies of Scale | External Economies of Scale |

|---|---|---|

| Source | Internal to the firm (decisions and actions controlled by the firm) | External to the firm (factors affecting the entire industry or region) |

| Cause | Growth and expansion of the firm’s own operations and production | Growth and expansion of the entire industry or economic cluster |

| Examples | * Technical: Using better technology and machinery for efficient production. * Managerial: Spreading fixed management costs over a larger output. * Financial: Negotiating better loan rates due to increased financial strength. * Marketing: Gaining bargaining power with suppliers for bulk discounts. | * Skilled Labor Pool: Availability of skilled labor due to industry concentration in a region. * Specialized Suppliers: More specialized suppliers catering to the industry’s needs. * Infrastructure Development: Improved infrastructure like roads and transportation due to industry growth. * Knowledge Spillovers: Sharing of knowledge and advancements within the industry. |

| Control | Within the firm’s control through strategic decisions and operational efficiency. | Outside the firm’s control, depends on the industry and broader economic environment. |

| Impact on Cost Curve | Shifts the Long-Run Average Cost (LAC) curve downward, leading to lower average cost per unit. | Shifts the entire LAC curve downward for all firms in the industry, benefiting all participants. |

What is Internal Economies of Scale?

Internal economies of scale refer to the cost advantages and efficiency gains that a firm experiences as it expands its production and operations. These advantages arise from factors within the firm itself, leading to reduced average costs per unit of output. Internal economies of scale can manifest in various forms:

1. Technical Economies

- Specialization: Larger-scale production allows for specialized machinery and equipment, increasing efficiency and reducing costs.

- Division of Labor: As the scale of operations grows, tasks can be divided among specialized workers, enhancing productivity.

2. Managerial Economies

- Managerial specialization: Larger firms can afford specialized managers, leading to better coordination and decision-making.

- Administrative efficiency: With increased scale, administrative overhead per unit of output decreases, contributing to cost savings.

3. Financial Economies

- Access to capital: Larger firms often have easier access to capital markets, obtaining funds at lower costs.

- Economies of scale in financing: The cost of financing, such as issuing bonds or obtaining loans, tends to decrease as the scale of operations increases.

4. Marketing Economies

- Bulk purchasing and selling: Large-scale production enables firms to negotiate better deals with suppliers and reach cost-effective agreements with customers.

- Advertising efficiency: Marketing costs per unit decrease as advertising expenses are spread across a larger production volume.

5. Risk-Bearing Economies

- Diversification: Larger firms can diversify their product lines, reducing the impact of fluctuations in demand for any specific product.

- Risk-sharing: Risks associated with economic downturns or market changes can be spread across a larger and more diverse operation.

6. Research and Development Economies

- Increased innovation: Larger firms can allocate more resources to research and development, fostering innovation and technological advancement.

- Economies in innovation: The cost of developing new technologies can be spread over a larger production volume, reducing the per-unit cost.

What is External Economies of Scale?

External economies of scale refer to the cost advantages that accrue to all firms in a particular industry as a result of the industry’s overall expansion and growth. These benefits arise from factors external to individual firms but impact the industry collectively.

1. Shared Infrastructure

- Definition: External economies can manifest through shared infrastructure, where multiple firms in an industry benefit from common facilities and services, leading to cost savings.

- Example: A technology park housing multiple software companies allows them to share high-speed internet, reducing individual connectivity costs.

2. Improved Transportation Networks

- Definition: Expansion of transportation networks, such as highways, ports, or railways, can lead to external economies by lowering transportation costs for all firms within the connected region.

- Example: A new expressway connecting manufacturing hubs reduces transportation costs for various companies, fostering industry-wide efficiency.

3. Knowledge Spillovers

- Definition: External economies can result from knowledge spillovers, where advancements in technology or expertise achieved by one firm benefit others within the industry.

- Example: A research institution in a biotech cluster may share findings, benefiting multiple pharmaceutical companies in the vicinity.

4. Economies of Scale at Industry Level

- Definition: As an industry expands, it can achieve external economies of scale through bulk purchasing, joint research initiatives, and coordinated marketing efforts that benefit all participating firms.

- Example: A growing solar energy industry benefits from joint purchasing of raw materials, reducing costs for all solar panel manufacturers.

5. Government Policies and Incentives

- Definition: Government initiatives, such as tax breaks or subsidies, can create external economies by fostering an environment conducive to industry growth and efficiency.

- Example: A government offering tax incentives to a burgeoning tech sector encourages the growth of multiple IT companies, resulting in shared cost advantages.

Main Differences Between Internal and External Economies of Scale

- Source:

- Internal Economies: Stem from cost savings within a firm as it expands, optimizing its internal processes and operations.

- External Economies: Arise from industry-wide growth and external factors that benefit multiple firms within the industry.

- Location:

- Internal Economies: Originates within the boundaries of the individual firm, often related to increased specialization and efficient resource utilization.

- External Economies: Extend beyond the boundaries of a specific firm, affecting multiple firms within the industry due to shared resources, infrastructure, or industry growth.

- Control:

- Internal Economies: Firms have direct control over internal factors contributing to cost savings, such as production processes and resource allocation.

- External Economies: Result from external factors like industry expansion, shared infrastructure, or government policies, over which individual firms have limited control.

- Scope:

- Internal Economies: Primarily concern the specific firm’s operations and efficiency improvements.

- External Economies: Encompass industry-wide developments, impacting all firms within a particular sector.

- Examples:

- Internal Economies: Increased specialization, efficient production, and economies in resource usage within the firm.

- External Economies: Shared infrastructure, improved transportation networks, knowledge spillovers, and economies achieved at the industry level.

- Nature:

- Internal Economies: Arise from factors within the firm, often driven by its management decisions and organizational structure.

- External Economies: Result from external circumstances, industry dynamics, and collaborative efforts within the broader economic environment.

- https://repository.ubn.ru.nl/bitstream/handle/2066/193934/193934.pdf

- https://www.nber.org/papers/w3033

- https://link.springer.com/article/10.1007/s10842-010-0069-y

The post provides a thorough comparison between internal and external economies of scale.

The comparison was aptly executed, providing clear distinctions between the two types.

The primary differences were effectively highlighted, making it easier to comprehend.

It would be beneficial to see real-world examples that relate to the content explained in the article.

This article has enriched my understanding of Alfred Marshall’s concepts regarding internal and external economies of scale.

It’s always fascinating to see these concepts explained thoroughly.

The content has a high intellectual value, but a more interactive approach could make it even more engaging.

An interactive element would certainly elevate the reader’s interest in the subject.

Indeed, a touch of interactivity and engagement could further enhance the overall appeal.

The content is certainly rich in information, but it would be more engaging if a hint of humor was added to the text.

A touch of humor would certainly lighten the intensity of the topic.

Humor would indeed make the post more reader-friendly without compromising its scholarly nature.

The comparisons and contrasts drawn between internal and external economies of scale are incredibly illuminating.

The clarity in distinguishing between the two was very helpful and insightful.

It has provided a comprehensive understanding of the subject matter.

The article’s in-depth discussion of technical and managerial economies of scale has expanded my knowledge substantially.

It covers an array of topics related to economies of scale in a detailed manner.

The delivery of the content is detailed yet easy to understand. It’s a great source of information on economies of scale.

I completely agree. It’s an enlightening read for anyone interested in microeconomics.

Yes, it’s quite informative without sounding pretentious.

The article effectively addresses the various types of external economies of scale, shedding light on the different facets of the subject.

It’s a comprehensive read, providing valuable insights with regards to economies of scale.

Indeed, it’s an enlightening post that gives a thorough understanding of external economies.

Although the content is comprehensive, the manner in which it is presented can be a bit dry.

Indeed, the topic could have been approached in a more engaging manner.