Entrepreneurs are the backbone of the economy. Business is an emotion. Before starting anything new, gaining knowledge in that field leads to a better path and victory.

Shares and stock markets are now the latest trends for investing. Investing or sharing your money in a business is an easy process for multiplying your money. The redeemable and irredeemable shares are vital in stocks and shares.

Key Takeaways

- Redeemable preference shares allow the issuer to buy back shares after a predetermined period, whereas irredeemable preference shares do not have a maturity date.

- Redeemable shares provide more flexibility for the issuer, while irredeemable shares offer stability for the shareholder.

- Irredeemable preference shares tend to pay higher dividends to compensate for the lack of a redemption option.

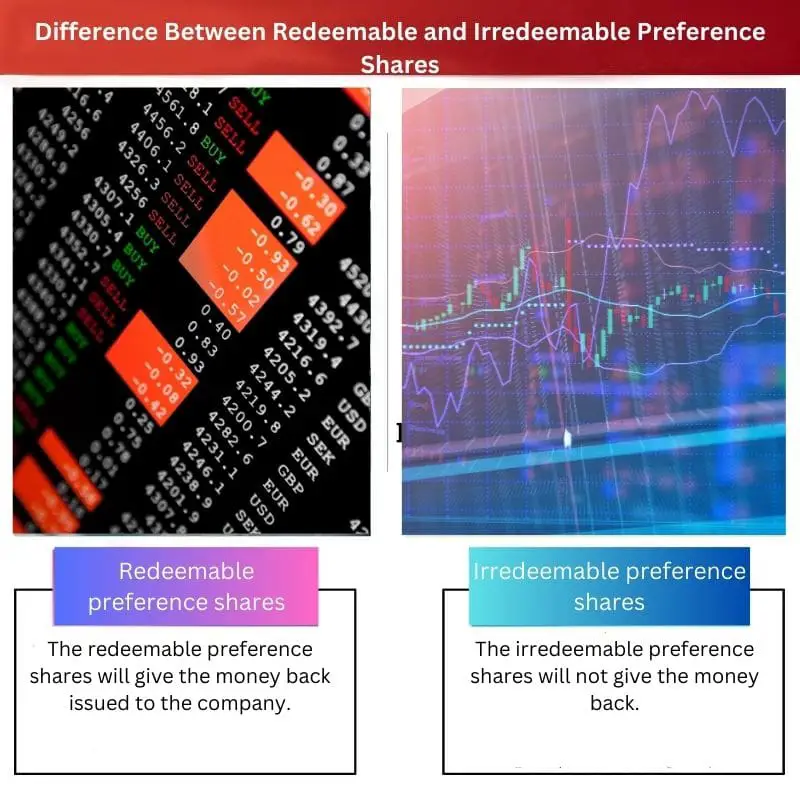

Redeemable preference shares Vs Irredeemable preference shares

The difference between redeemable and irredeemable shares is their money-back policy. The redeemable preference shares work on the concept where you can buy the money issued to the company within its maturity period. The irredeemable preference shares work on the theory. Here, you can’t procure the money endowed to the company till the company is going concerned. The permanence will differentiate the redeemable and irredeemable shares. Redeemable shares provide befits to the shareholders, unlike irredeemable shares.

The redeemable preference shares are an agreement between the company and the shareholder. The stipulation is the company must pay back the dues of the shareholder within the maturity period. It is also a pro for the company to buy the shares of the shareholders.

The redeemable shares make sufficient space to enter third-party investors with agreed terms and policies. The company must be sure about the article of association. The director can take over the authority for issuing the shares.

The irredeemable preference shares are not a stable agreement between shareholders and the company. In irredeemable shares, the shareholders can only back the money in the liquidation of the company. The irredeemable shares are present in the company until the company lives.

It becomes the permanent asset for the issuing company, the shares divided among the shareholders for perpetuity. There are laws involved in the allocation of irredeemable shares.

Comparison Table

| Parameters of Comparison | Redeemable preference shares | Irredeemable preference shares |

|---|---|---|

| Definition | The redeemable preference shares will give the money back issued to the company. | The irredeemable preference shares will not give the money back. |

| Buying back | The redeemable shares can buyback at any time. | The irredeemable shares are bought only at the liquidation of the company. |

| Perpetuity | The permanence does not exist in redeemable shares | The permanence lives in irredeemable shares. |

| Popularity | More popular | Comparatively less popular. |

| Benefits | Provide more benefits to the company. | Provide fewer benefits to the company. |

| Continuity | Divided parts exit until money won’t be received back. | Dividend parts live till the permanence. |

What are Redeemable preference shares?

The redeemable preference shares are something that gives the money back invested in the company. It provides an agreement between the company and the shareholders. In the end, it awards surety about the money invested in the company.

The article of the association will contain all the documents regarding your investments, shares, potential, etc. The term called redemption includes the date and time for future enhancement.

The redeemable shares provide space to third-party investors like venture capitalists to subject the reserves. It sometimes helps to redeem the shares using the exit strategy. The redeemable shares can buy the shareholders at some point.

The authority is passed to the director-general. He takes care of the distribution of the shares among shareholders. The shareholders need not approve the redemption if they receive the shares.

If the shares are purchased by the article of association, then the shares are considered as purchase of own shares.

The shares are not easily redeemed. It must go through restrictions provided by the laws of the company and government. The portion can be purchased under the purchase of own shares only if the company makes the shares out distributable to the employees.

The new shares were created to buy their purchase. It is called permissible capital payment on an additional purchase. If the shares are redeemed once, then they are cancelled.

What is Irredeemable preference shares?

The irredeemable preference shares are unlike redeemable. They can not give the money back invested in the company. The amount can be redeemed only at the time of liquidation of the company.

The agreement doesn’t show anything regarding the money-back policy. It doesn’t provide any profits or benefits to the company. The irredeemable shares become a permanent liability once it is invested till the permanence of the company.

The extinguishment policy works only at the time of liquidation of the company. It doesn’t provide any offers in giving back money but provides a discount on the degree of certainty in the dividend of the shares among shareholders. It grants a pro to the company.

Deciding the portion based on the financial condition of the company will result in less loss. It is not much popular as the redeemable preference shares. The maturity period never determined at the time of investment is a disadvantage of irredeemable shares.

It is treated as profits and distributed as gain to the company. You can’t get the capital back as it is. By the act of 2003, the irredeemable shares need not redeem. Priority plays the role which beats equity.

The irredeemable shares work on concession than equality. Perpetual shares or non-redeemable shares are some other names of irredeemable shares.

Main Differences Between Redeemable preference shares and Irredeemable preference shares

- The redeemable shares provide the money back, and the irredeemable shares won’t issue the money back.

- The redeemable shares can buy back at any time, and the irredeemable shares are bought only at the end.

- Permanence does not exist in redeemable shares, and permanence lives in irredeemable shares.

- Redeemable shares are more popular, and irredeemable shares are comparatively less popular.

- Redeemable shares provide more benefits to the company, and irredeemable shares give fewer benefits to the company.

- https://www.researchgate.net/profile/Asri-Noer-Rahmi/publication/353391465_IHMC-2017-E-PROCEEDING/links/60f9dd852bf3553b29067893/IHMC-2017-E-PROCEEDING.pdf#page=105

- https://platform.almanhal.com/Files/Articles/116222

The article offers a comprehensive overview of redeemable and irredeemable preference shares, shedding light on the implications for both companies and shareholders.

I completely agree. This knowledge is crucial for ensuring sound financial decisions.

Absolutely. Understanding the differences between these shares is fundamental for shareholders and potential investors.

The article elucidates the differences between redeemable and irredeemable preference shares, shedding light on the implications for both companies and shareholders. It’s an essential read for anyone interested in stock market investments.

Absolutely. This information is indispensable for informed investment decisions.

The comparison table provided in the article presents a clear and concise overview of the distinctions between redeemable and irredeemable preference shares. It’s crucial for potential investors to have this knowledge.

Agreed. The comparison table serves as a valuable reference for those looking to enter the stock market.

Absolutely. Understanding the benefits and limitations of these shares is essential for making informed investment choices.

The article provides a comprehensive overview of redeemable and irredeemable preference shares, offering valuable insights for individuals seeking to invest in shares and stocks.

I completely agree. This knowledge is essential for shareholders and potential investors alike.

The article effectively outlines the distinctions between redeemable and irredeemable preference shares, providing valuable insights for individuals seeking to invest in the stock market.

I couldn’t agree more. This knowledge is indispensable for anyone considering stock market investments.

Indeed. It’s crucial for shareholders to have a clear understanding of these shares and their implications.

Investing in stocks and shares can be a very profitable move, as long as investors have a good understanding of redeemable and irredeemable preferences shares and the differences between them.

I agree. It’s essential to have a thorough understanding of the different types of shares before making investment decisions.

The article offers a detailed comparison of redeemable and irredeemable preference shares, providing valuable insights for potential investors and shareholders.

Agreed. Understanding the differences between these shares is crucial for informed investment decisions.

Absolutely. This information is essential for those navigating the stock market.

The article provides an insightful analysis of the differences between redeemable and irredeemable preference shares. It’s important for shareholders to understand the implications of these distinctions.

Absolutely. Shareholders need to be well-informed to make sound investment decisions.

The article offers a comprehensive comparison of redeemable and irredeemable preference shares, providing valuable insights for potential investors and shareholders. This knowledge is crucial for making informed investment decisions.

I completely agree. Understanding these distinctions is essential for anyone entering the stock market.

Absolutely. This is important information for anyone considering stock market investments.

The article provides an in-depth analysis of redeemable and irredeemable preference shares, offering valuable insights for potential investors. This knowledge is fundamental for making sound investment decisions in the stock market.

Indeed. Understanding these differences is crucial for anyone considering stock market investments.

I couldn’t agree more. This information is essential for navigating the world of stock market investments.