Shares and Debentures are two of the most common methods of raising capital funds for a new venturing company or a company looking for an expansion or upgrade.

Selling out shares and debentures in the marketplace is one of the surest ways to attain a large sum of money. Hence as an investor, the question of buying shares or debentures is bound to pop up.

Key Takeaways

- Shares represent ownership in a company, whereas debentures are a form of debt issued by the company.

- Shareholders are entitled to dividends based on company profits, while debenture holders receive fixed interest payments.

- Shares carry voting rights, allowing shareholders to influence company decisions, but debenture holders do not have voting rights.

Shares vs Debentures

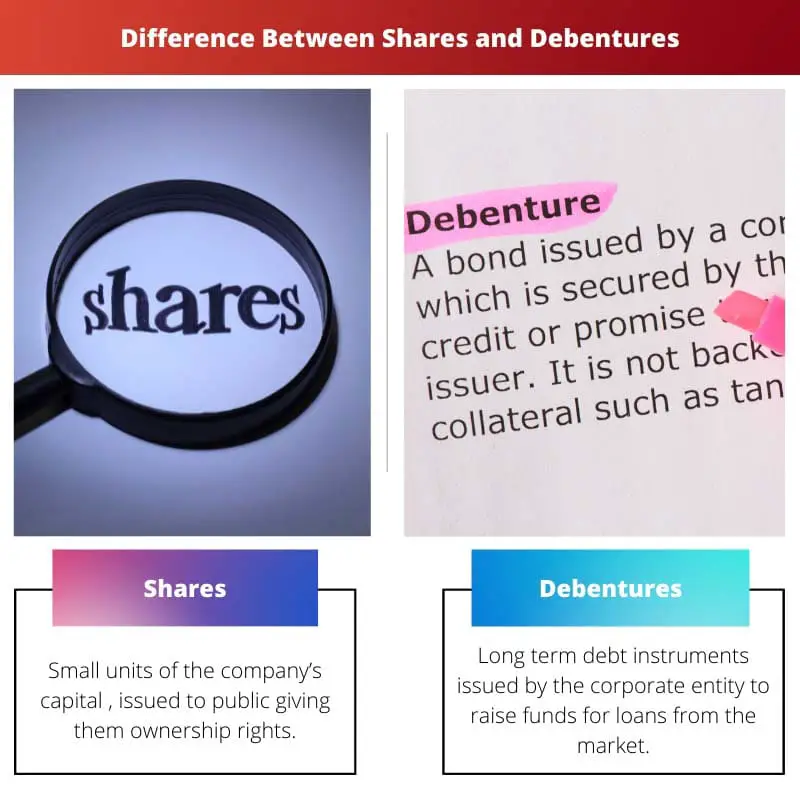

Shares represent ownership in a company and provide shareholders with voting rights and the potential for dividends and capital gains. Debentures are a form of debt issued by a company that pays fixed interest to debenture holders but does not grant ownership or voting rights.

Shares are small, finite divisions of the company’s capital. Purchasing a share gives its owner (called shareholder) rights to the company’s capital in proportion to the shares owned. In return, the investor is paid dividends of profit earned by the company.

Debentures are long-term debt instruments issued by the company to raise capital under its seal. The investor does not own any capital rights to the company, but the company is indebted to the investor (called debenture holder).

In return, the debenture holder is paid interest on the loaned amount periodically.

Comparison Table

| Parameters of Comparison | Share | Debenture |

|---|---|---|

| Meaning | Small units of the company’s capital , issued to public giving them ownership rights | Long term debt instruments issued by the corporate entity to raise funds for loans from the market |

| Ownership | Owned capital | Borrowed capital |

| Holder Name | Share holder | Debenture holder |

| Holder rights | The owner owns rights to the company’s capital and also voting rights in case of | The owner has no such rights. |

| Conversion | Shares cannot be converted to debentures | Debentures can be converted into shares. |

| Returns | Paid in form of dividends of profit | Paid in form of loan interest. |

| Risk | Risky as it fluctuates with performance and profits | Risky, however, returns are secured. |

| In case of loss/liquidation | No returns | In case of liquidation of company debenture holders is the first to be repaid. |

What is a Share?

A share or equity, or capital stock, is the smallest unit of a company’s capital. A company’s capital is divided into small, finite divisions that are sold to the public to raise funds.

Owning a certain percentage of a company’s share gives the shareholder ownership of the said percentage of the company.

For e.g. is a person purchase 10 shares out of 100 of a company, he /she owns 10% of the company. Similarly, if a person owns more than 50 % of capital shares, he is said to be the company’s major shareholder, while the others are minors.

As the owner of the company’s capital, the shareholder has entitled to voting and ownership rights. The owner is paid dividends of profits of the company. The shares can also be traded in stock markets for value.

Shareholding can be risky as it fluctuates with the profits, and in case of liquidation of the company, the shareholder is not returned his share in the capital; however it offers high returns to investors.

Shares can be of two types:

- Equity Shares: These are also called common/ ordinary shares. These shares can be traded on the stock exchange.

- Preference Shares: These are shares that have preference over normal shares as in case of liquidation of the company, these shareholders are the first to be considered.

What is a Debenture?

Debentures are debt tools issued by the corporate entity to raise funds as loans from the public. In simple words, the company is indebted to you. The owner of a debenture is called a debenture holder.

Usually, a debenture has a lower interest rate than a bank loan or overdraft. The interest rate in itself may be fixed or floating.

The company is entitled to pay returns to you in the form of loan interest, payable over a long period. Debentures are convertible into shares. However, a debenture holder possesses no rights as the capital is not owned but burrowed.

Comparatively, debenture investors face lower risk even in the case of liquidation of the company, repayment is assured.

Debentures are of the following types:

- Perpetual Debentures: As the name suggests, these are lifelong tools that do not mature. They are treated much like equities and serve as a lifelong source of income for the debenture holder.

- Redeemable Debentures: These debentures are fixed for a certain period of time, and on the expiry of this term, the principal amount is repaid.

- Convertible Debentures: These are long-term debt tools issued by the company that can be converted into shares/equities after a certain period of time.

Main Differences Between Shares and Debentures

- Shares are owned capital, while debentures are burrowed.

- Shareholders have rights over the company’s capital, while debenture holders do not.

- Returns are paid in the form is profit dividends to shareholders while debenture holders are repaid interest of the burrowed amount

- Shares are rigid and non-convertible, while debentures are more flexible.

- Investors face high risk in shareholding as returns depend on fluctuations in market and performance and also face the risk of liquidation however, debenture holders have the first claim over the company’s asset in case of liquidation.

- https://journals.sagepub.com/doi/pdf/10.1177/00197939860390

- https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6261.1966.tb02953.x

Understanding the concept of debentures being essentially a loan to a company helps investors understand their risk and return potential.

Details about equity and preference shares are insightful and provide a clear understanding of share types.

The distinction between equity shares and preference shares is important for shareholders to weigh their investment decisions.

The discussion around the risks and returns of shares and debentures provides valuable insights for potential investors.

Learning about the differences between shares and debentures is essential for anyone looking to invest wisely.

Absolutely, Oadams. This information is invaluable for prospective investors.

Agreed. Making informed decisions based on these details is vital in the investment landscape.

These financial instruments are crucial for understanding company finances and making informed investment decisions.

I agree, Mark. It’s essential for investors to understand the differences between shares and debentures.

Absolutely, understanding these differences can make a significant impact on investment strategies.

The distinction between shares and debentures’ ownership and rights is a crucial point for investors to consider.

I completely agree, Davis. This knowledge is essential for any smart investor.

The comparison table is a helpful overview for anyone considering investing in shares or debentures.

The clear explanation of perpetual debentures is enlightening and applicable to investors looking for long-term financial tools.

Shares and debentures have their unique advantages and risks. Knowing their differences can help investors make more informed decisions.

Indeed, understanding risk and return in each investment option is critical for investors.