Nowadays, smartphones are providing the most advanced features to users. Online payments are getting popular with the advancement in smartphones.

Various companies have launched their applications and wallet-based platforms to ease transactions from one person to another.

PayPal and Venmo are two such online payment platforms that are serving or used by millions of people worldwide to ease their transactions and payments.

These platforms are used to electronically send or receive money from one another person.

Key Takeaways

- PayPal is a digital payment platform that allows users to send and receive money, while Venmo is a mobile payment app owned by PayPal.

- PayPal offers a wider range of services, including international transfers and business accounts, while Venmo focuses on peer-to-peer payments and social features.

- PayPal charges fees for some transactions, while Venmo does not charge fees for sending or receiving money.

PayPal vs Venmo

The difference between PayPal and Venmo is that Paypal is an online payment platform that is widely used to send and receive money by using the internet. It is a convenient platform for transferring money to known ones, online shops, etc. On the contrary, Venmo is a mobile application that was launched by considering the convenience of customers who purchase with authorized merchants or sellers.

Paypal is an online payment platform established in the year 1998. This platform is used to transfer money even abroad to your close ones or merchants.

Any individual can transfer or send money by using your email address which is consequently linked to your personal Paypal account.

Venmo is also an online payment application that you can use to send or receive money. The amount is directly sanctioned to the bank account linked to the Venmo application.

The money is transferred on business days and reviewed as well, which also results in delays. This effective application is used in the United States only.

Comparison Table

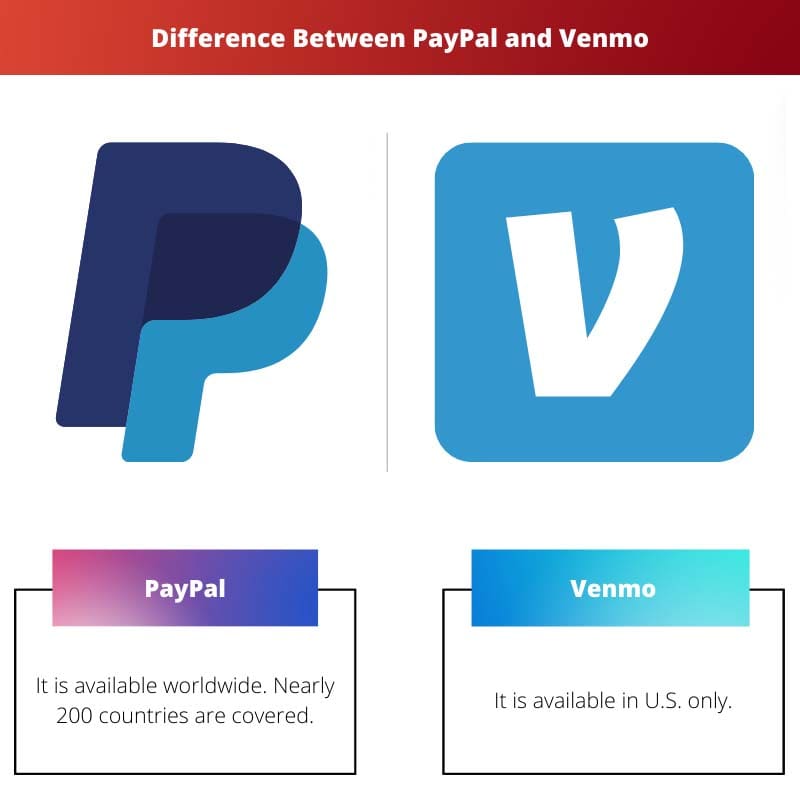

| Parameters of Comparison | Paypal | Venmo |

|---|---|---|

| Availability | It is available worldwide. Nearly 200 countries are covered. | It is available in U.S. only. |

| Payment Method | Credit, Debit card, bank transfer, and PayPal funds | Credit, Debit card, bank transfer, and Venmo funds |

| Security | Data Encryption | Data Encryption |

| Withdrawal Timeframe | 3-5 business days | 1-3 business days |

| Best For | Paypal is majorly suitable and best for merchants or businesses | Venmo is best for everyday users or P2P |

What is PayPal?

PayPal is one of the popular online platforms which is launched in the year 1998 and specifically focuses on online commerce.

This platform allows users to easily make payments by using online mode and its application. Any individual can use this platform by linking their bank account with PayPal.

It is majorly used by various online merchants and e-commerce platforms.

PayPal has a one-touch feature that enables users to shop from merchants conveniently in just a few clicks.

The payment or transfer methods of this platform include credit, debit card, bank transfer, and PayPal funds. The one-touch feature easily works on both desktop and mobile.

Users can use this platform to deposit checks into their accounts.

What is Venmo?

Venmo is an online payment platform available in the United States only, and it was launched to send or transfer money to other Venmo users more conveniently.

The users can deposit a check in their linked Venmo account by simply taking a picture from the Venmo application.

Venmo is a merchant and e-commerce-friendly application that is specifically designed for transferring money fast.

No fee is charged for the debit card purchase and offered to the users to easily make payments by scanning the QR code. Users can make the payment by using its application.

Main Differences Between PayPal and Venmo

- PayPal and Venmo are online payment platforms that are effectively used for receiving or sending money or making transactions. Both of these platforms are used effectively for making payments to merchants, e-commerce, and personal use as well. However, the reach and availability of these applications create a major difference. PayPal is an available worldwide platform that is used by millions of people in nearly 200 countries. On the contrary, Venmo is available in the United States only.

- PayPal and Venmo are free-to-use platforms that anyone can use by simply registering themselves and linking their bank account. The card or the transaction fees of these platforms varies from one another. Payment or the transfer method of PayPal includes credit, debit card, bank transfer, and PayPal funds. On the other side, the transfer method of Venmo is also similar to that of PayPal. The only difference is Venmo Funds.

- PayPal and Venmo have data encryption security to enhance the reliability of the users. These online payment platforms have apps for better convenience services and data security for the users.

- The withdrawal frame somehow affects the financial activity of the users. Various platforms are available in the market with different withdrawal frames. In the case of PayPal, the withdrawal frame is comprised of 3-5 business days. While in Venmo, this withdrawal frame consists of 1-3 business days.

- PayPal and Venmo are quite famous platforms that are commonly used for transferring money to merchants or for personal use. With variations in transfer limits, these platforms are launched for different purposes. PayPal is majorly used for businesses or merchants. On the contrary, Venmo is majorly used for personal or everyday use.

- https://ojs.aaai.org/index.php/ICWSM/article/view/14873

- https://digitalcommons.lmu.edu/cgi/viewcontent.cgi?filename=0&article=1253&context=honors-research-and-exhibition&type=additional

An insightful comparison of PayPal and Venmo, it’s great to have a detailed breakdown of their differences and capabilities.

I found the comparison table provided here to be particularly helpful in understanding the key differences between PayPal and Venmo.

Absolutely, this article has effectively outlined the unique features and benefits of each platform.

The article has effectively highlighted the distinct features of both PayPal and Venmo, making it easier for users to choose according to their needs.

Yes, understanding the unique capabilities of PayPal and Venmo is essential for informed decision-making.

Absolutely, the comparison provides valuable insights into the specific applications of each platform.

I always wondered about the main differences between PayPal and Venmo, and this article has provided me with a comprehensive comparison. Thank you!

The global availability of PayPal and the convenience of Venmo for U.S. users are certainly important distinctions to consider.

I completely agree, this article has provided valuable insights into both online payment platforms.

The article has effectively explained the use cases and functionalities of both PayPal and Venmo, allowing users to understand their specific applications.

Absolutely, the detailed comparison clarifies the distinct advantages of each platform for different types of transactions.

The article has clarified the specific uses and advantages of both PayPal and Venmo, making it easier to choose the right platform for different needs.

Yes, understanding their specific advantages can help users make informed decisions about which platform to use.

I agree, this detailed comparison highlights the unique strengths of each platform.

The in-depth comparison of PayPal and Venmo has certainly increased my understanding of these online payment platforms.

Absolutely, this article has effectively addressed the key differences and use cases of PayPal and Venmo.

The insights provided here have made it clearer how PayPal and Venmo cater to different user needs and preferences.

The detailed comparison of PayPal and Venmo has been very informative, offering a clear understanding of their unique features and benefits.

Yes, understanding their unique strengths and capabilities is crucial for users to make informed decisions.

I agree, the article provides valuable insights into the specific use cases and advantages of each platform.

As an online shopper, I appreciate the information on the different payment methods offered by PayPal and Venmo.

Yes, the availability and withdrawal timeframes are crucial aspects to consider when choosing between the two platforms.

The detailed comparison of PayPal and Venmo has been very informative and has emphasized their unique strengths and capabilities.

Absolutely, understanding the specific attributes of each platform can help users make informed decisions.

Yes, the article’s comprehensive breakdown is very helpful in evaluating which platform best suits individual requirements.